Iran's cards and payments industry is undergoing a significant transformation driven by digital innovation, changing consumer preferences, and regulatory reforms. As the country embraces digitalization, Iran Cards And Payments Market traditional payment methods are giving way to electronic and mobile payment solutions, reshaping the landscape of financial transactions. This article explores the evolving trends in Iran's cards and payments industry, highlighting the opportunities and challenges of digital transformation.

Overview of Iran's Cards and Payments Industry

Iran's cards and payments industry encompasses a diverse range of financial instruments, including debit cards, credit cards, prepaid cards, and mobile payment applications. The industry plays a crucial role in facilitating domestic and international transactions, enabling individuals and businesses to access financial services, make purchases, and manage their finances.

Key Players in Iran's Payments Ecosystem

- Central Bank of Iran (CBI): Regulator and policymaker overseeing the country's banking and financial sector, including payment systems and electronic banking services.

- Commercial Banks: Financial institutions offering a wide range of banking services, including card issuance, payment processing, and merchant acquiring.

- Payment Service Providers (PSPs): Third-party entities facilitating electronic payments and money transfers through online platforms and mobile applications.

- Telecommunication Companies: Telecom operators collaborating with banks and PSPs to offer mobile payment and digital wallet services to customers.

Digital Transformation Trends

1. Adoption of Mobile Payments

The proliferation of smartphones and internet connectivity has fueled the adoption of mobile payment solutions in Iran. Mobile payment apps, such as Shaparak, Sadad, and Hamrah Card, enable users to make payments, transfer funds, and manage their finances conveniently from their mobile devices. The convenience and accessibility of mobile payments appeal to a broad spectrum of consumers, driving growth in the mobile payments market.

2. Expansion of E-commerce

The growth of e-commerce platforms and online shopping portals is driving demand for electronic payments in Iran. Consumers increasingly prefer to shop online for a wide range of goods and services, including electronics, apparel, and groceries, necessitating secure and convenient payment solutions. E-commerce merchants and payment service providers are collaborating to offer seamless payment experiences and support the growth of online commerce.

3. Contactless Payments

Contactless payment technology is gaining traction in Iran, allowing consumers to make fast and secure transactions using contactless-enabled cards or mobile devices. Contactless payments offer convenience, speed, and enhanced security, reducing the need for physical contact with payment terminals and minimizing the risk of fraud. Merchants are upgrading their point-of-sale terminals to support contactless payments, catering to consumer preferences for touch-free transactions.

4. Regulatory Reforms

The Central Bank of Iran (CBI) has introduced regulatory reforms to promote electronic payments and digital banking services in the country. Initiatives such as the National Payment Switch (Shaparak), Real-Time Gross Settlement (RTGS) system, and Payment Service Providers (PSP) licensing framework aim to modernize the payments infrastructure, enhance interoperability, and foster innovation in the financial sector.

Challenges and Opportunities

1. Infrastructure Development

Despite significant progress, Iran's payments infrastructure still faces challenges related to interoperability, reliability, and security. Enhancing the country's payments infrastructure requires investment in technology, cybersecurity, and digital literacy to ensure the seamless operation of electronic payment systems and safeguard against cyber threats.

2. Financial Inclusion

Promoting financial inclusion remains a priority for Iran's government and regulators, particularly in rural and underserved areas. Digital payments can expand access to financial services, empower underserved populations, and drive economic growth. Initiatives to promote financial literacy, expand banking services, and incentivize digital transactions can foster greater financial inclusion and participation in the formal economy.

3. Cybersecurity and Data Privacy

As digital transactions increase, cybersecurity and data privacy emerge as critical concerns for consumers, businesses, and regulators. Safeguarding sensitive financial information, protecting against cyber threats, and ensuring compliance with data protection regulations are paramount for building trust and confidence in digital payment systems. Collaboration between government agencies, financial institutions, and technology providers is essential to strengthen cybersecurity measures and mitigate risks.

Conclusion

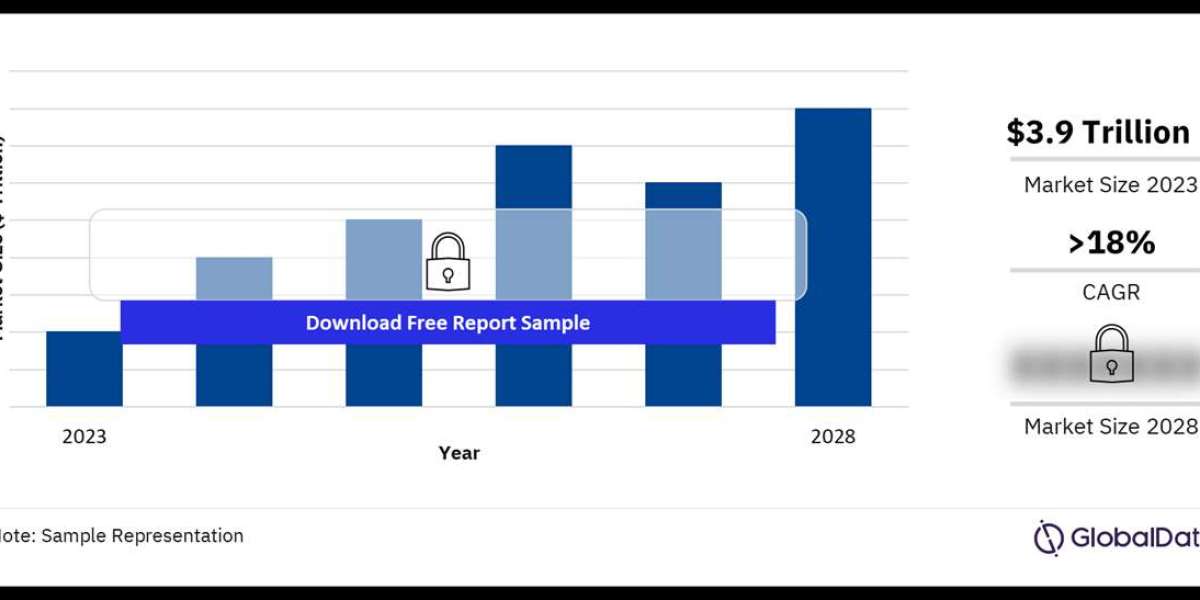

The digital transformation of Iran's cards and payments industry presents significant opportunities for innovation, economic growth, and financial inclusion. As the country embraces digitalization, mobile payments, e-commerce, and contactless technology are reshaping the way individuals and businesses transact. While challenges such as infrastructure development, financial inclusion, and cybersecurity persist, concerted efforts by stakeholders can drive the industry forward, creating a more accessible, efficient, and secure payments ecosystem for all. Buy the Full Report for More Information on the Iran Cards and Payments Market Forecast Download a Free Sample Report