Carbon Credit Market Overview

Maximize Market Research, a Carbon Credit business research firm has published a report on the “Carbon Credit Market”. Which provides Industry Analysis (business insights, demand analysis, pricing analysis, and competitive landscape).

Estimated Revenue Growth:

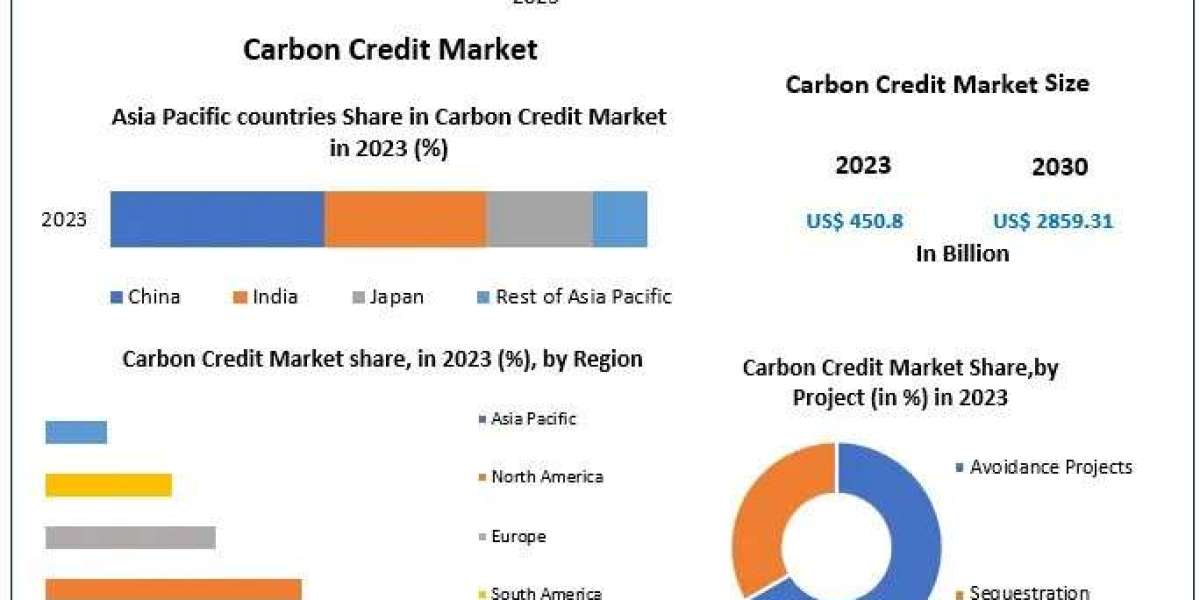

The Carbon Credit Market size was valued at USD 450.8 Bn in 2023 and the total Carbon Credit Market revenue is expected to grow by 30.2 % from 2024 to 2030, reaching nearly USD 2859.31 Bn by 2030.

For an in-depth analysis, click the provided link: https://www.maximizemarketresearch.com/request-sample/198127

Carbon Credit Market Report Scope and Research Methodology

Maximize Market Research, a leading business research firm, presents a comprehensive analysis of the Carbon Credit Market. This report delves into industry dynamics, demand patterns, pricing structures, and competitive landscapes, offering invaluable insights for stakeholders across various sectors.

The assessment of the Carbon Credit Market employs a meticulous approach, combining primary and secondary research methodologies. Primary research involves direct engagement with industry experts, suppliers, producers, and consumers, while secondary research draws from trusted sources such as market reports, industry publications, and government data. Historical trends, competitor analysis, and data modeling techniques further enrich the research process, ensuring accurate market predictions and growth evaluations.

Dynamics of the Carbon Credit Market

Strengthening the Focus on Sustainability to Expand the Market for Carbon Credits

The carbon credit market is anticipated to be driven by the expanding corporate social responsibility and increased awareness among businesses of the need to reduce greenhouse gas emissions in order to reach zero-emission objectives. Of all the industrial verticals, the financial sector is the one that is actively involved in the development of the carbon credit market since it has understood its potential. Financial institutions are adding carbon credits to their investment portfolios, setting up specialised funds, and investing in carbon credit projects. The financial sector's increased involvement in the market creates a revenue stream that improves transparency, draws in new capital, and is anticipated to fuel the expansion of the carbon credit market.

Carbon Credit Market Segmentation

by Project

Avoidance Projects

Sequestration Projects

by Type

Compliance Market

VoluntaryMarket

by Application

Energy and Power

Aviation

Transportation

Industrial

Others

According to application, the carbon credit market's highest share is anticipated to belong to the energy & electricity segment in 2023. The Paris Agreement's emphasis on lowering greenhouse gas emissions has spurred a rise in renewable energy projects worldwide. The industrial sector is shifting from high-emission fossil fuel-based technologies to low-emission technologies that integrate sustainable energy into their operational procedures as a result of the global shift towards sustainable energy sources like solar, wind, and hydropower. The primary source of greenhouse gas emissions is the production of energy and power. These elements are anticipated to fuel the growth of the carbon credit market's energy and power segment.

Instant Access to Your Exclusive Sample Copy: https://www.maximizemarketresearch.com/request-sample/198127

Carbon Credit Market Key Players

1. BP Target Neutral

2. JPMorgan Chase & Co.

3. Gold Standard

4. Carbon Clear

5. South Pole Group

6. 3Degrees

7. Shell

8. EcoAct

9. CBL Markets

10. Carbon Credit Capital

11. ClimateCare

12. VCS (Verified Carbon Standard)

13. Sindicatum Sustainable Resources

14. Mercury Capital Advisors

15. Nori

16. Carbon Trust

17. Veridium Labs

18. Natural Capital Partners

19. EDF Trading

Table of content for the Carbon Credit Market includes:

Part 01: Executive Summary

Part 02: Scope of the Carbon Credit Market Report

Part 03: Carbon Credit Market Landscape

Part 04: Carbon Credit Market Sizing

Part 05: Carbon Credit Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Carbon Credit Market Regional Insights

The market report covers North America, Europe, Asia Pacific, South America, and the Middle East&Africa comprehensively. It provides information on the market trends in these areas, enabling stakeholders to grasp the factors influencing the Carbon Credit industry environment. In addition, the report provides a thorough examination of the market size and market share in the industry, presenting valuable information and statistics for making well-informed decisions. Analysis assists businesses and investors in evaluating the competitiveness of the market and recognizing potential areas for growth.

Want your report customized? Speak to an analyst and personalize your report according to your needs @ : https://www.maximizemarketresearch.com/request-sample/198127

Key questions answered in the Carbon Credit Market are:

- What growth strategies are the players considering to increase their presence in Carbon Credit?

- What are the upcoming industry applications and trends for the Carbon Credit Market?

- What segments are covered in the Carbon Credit Market?

- Who are the key players in the Carbon Credit market?

- What is Carbon Credit?

- What segments are covered in the Carbon Credit Market?

- Who are the leading companies and what are their portfolios in Carbon Credit Market?

- What was the Carbon Credit market size in 2023?

Key Offerings:

- Market Size, Share, Size & Forecast by different segment | 2024−2030

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, IndiaC

+91 96071 95908, +91 9607365656

Our Most Popular Report

Global Semiconductor Assembly and Testing Services Market: https://www.maximizemarketresearch.com/market-report/global-semiconductor-assembly-and-testing-services-market/35637/

Access Control Market: https://www.maximizemarketresearch.com/market-report/global-access-control-market/27435/