In the dynamic digital payments market, several key players and entities compete to provide a wide range of payment services and solutions to consumers, merchants, and businesses.

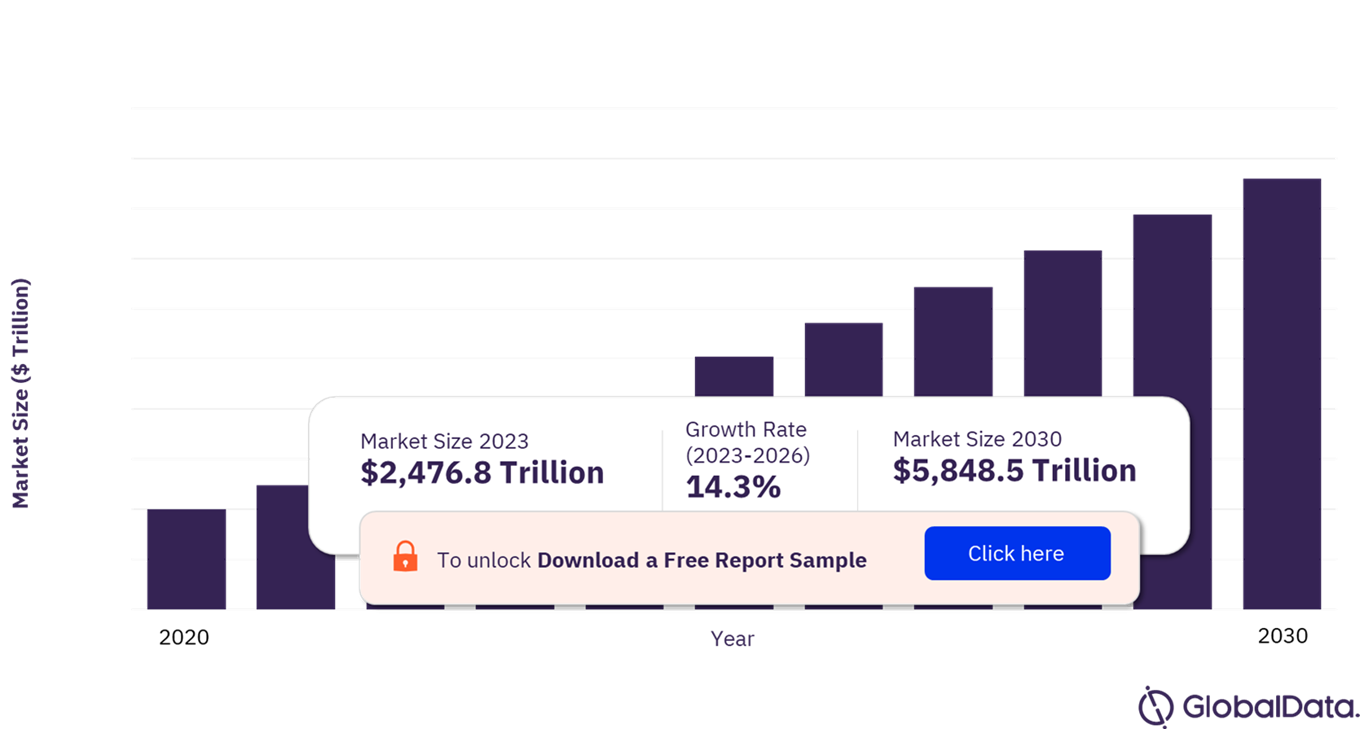

View Sample Report for Additional Insights on Digital Payments Market Forecast, Download a Free Report Sample

Here are some of the key players and their roles in the competitive landscape of the digital payments market:

Visa: Visa is one of the world's largest payment technology companies, facilitating electronic funds transfers and digital payments globally. Visa provides a range of payment solutions, including credit and debit cards, prepaid cards, mobile payments, and contactless payments. The company's network connects millions of merchants, financial institutions, and consumers worldwide.

Mastercard: Mastercard is another major player in the global payments industry, offering a wide range of payment products and services, including credit cards, debit cards, prepaid cards, and mobile payments. Mastercard's network enables secure and convenient electronic transactions for consumers and businesses across the globe.

PayPal: PayPal is a leading digital payments platform that enables online payments, money transfers, and peer-to-peer transactions. The company provides payment solutions for individuals, merchants, and businesses, including PayPal Checkout, PayPal Business, Venmo, and Braintree. PayPal's platform is widely used for e-commerce, online marketplaces, and digital goods and services.

Alipay: Alipay is a leading third-party mobile and online payment platform in China, operated by Ant Group (formerly part of Alibaba Group). Alipay provides a range of financial services, including digital payments, money transfers, bill payments, and wealth management. The platform has a large user base in China and has expanded its services globally.

WeChat Pay: WeChat Pay is a mobile payment platform integrated within the WeChat messaging app, operated by Tencent Holdings. WeChat Pay allows users to make mobile payments, send money to friends, and access various financial services through the WeChat app. WeChat Pay has a significant presence in China and is increasingly used by Chinese travelers and merchants overseas.

Apple Pay: Apple Pay is a mobile payment and digital wallet service developed by Apple Inc. that allows users to make contactless payments using their iPhone, Apple Watch, iPad, and Mac devices. Apple Pay securely stores payment information and supports in-store, in-app, and online transactions at participating merchants worldwide.

Google Pay: Google Pay is a digital wallet platform developed by Google that enables users to make payments using their Android devices, smartphones, and wearable devices. Google Pay supports contactless payments, peer-to-peer transfers, and online purchases, integrating with various payment methods and loyalty programs.

Square: Square is a financial services and mobile payment company that provides payment processing solutions for businesses of all sizes. Square offers a range of products and services, including point-of-sale systems, payment terminals, online payment processing, and peer-to-peer payments. Square's platform is widely used by small businesses, merchants, and entrepreneurs.

Stripe: Stripe is a technology company that provides online payment processing solutions for businesses, developers, and platforms. Stripe's suite of products includes payment APIs, checkout solutions, subscription billing, and fraud prevention tools, enabling businesses to accept payments online and optimize their payment workflows.

Adyen: Adyen is a global payment technology company that offers payment processing services for online, in-store, and mobile transactions. Adyen's platform provides a unified solution for accepting payments, managing transactions, and optimizing the payment experience for merchants and customers. Adyen serves a wide range of industries, including retail, e-commerce, travel, and hospitality.

These key players, along with numerous other banks, financial institutions, payment processors, fintech companies, and payment networks, compete in a dynamic and competitive digital payments market to provide innovative, secure, and convenient payment solutions to consumers and businesses worldwide. As the digital payments landscape continues to evolve, competition and innovation are expected to drive further advancements and expansion in the industry.