The oil and gas final investments market has been a staple of the global economy for decades. It plays a crucial role in supplying energy for industries, transportation, and residential needs. As the world evolves, so does this market, with shifts driven by technological advancements, geopolitical events, and environmental concerns.

Investing in this market offers unique opportunities, but it also comes with significant risks. To make informed investment decisions, it's essential to understand the current landscape, trends, and factors that influence the oil and gas industry. In this article, we'll delve into the key aspects of the oil and gas final investments market, explore recent developments, and provide insights to help you navigate this complex sector.

Overview of the Oil and Gas Final Investments Market

The oil and gas final investments market encompasses a broad range of activities, from exploration and extraction to transportation, refining, and distribution. It's a dynamic sector, with large multinational corporations and smaller independent companies working together to meet global demand for energy.

One of the key drivers in this market is the price of oil and gas, which is influenced by various factors, including supply and demand dynamics, geopolitical events, and economic trends. As a result, investors in this market must stay updated on global developments that could impact prices and the industry's overall stability.

Key Players in the Oil and Gas Final Investments Market

The oil and gas industry is dominated by major players, often referred to as "supermajors." These companies have extensive resources, expertise, and infrastructure to explore and produce oil and gas on a large scale. Some of the most notable supermajors include ExxonMobil, Chevron, BP, Royal Dutch Shell, and TotalEnergies. These companies have a significant presence in multiple countries and regions, allowing them to diversify their portfolios and reduce risk.

In addition to the supermajors, smaller independent companies also play a crucial role in the oil and gas market. These companies often focus on specific regions or segments of the industry, such as shale gas or offshore drilling. Their specialized knowledge and agility can provide investors with unique opportunities to tap into emerging trends and technologies.

Current Trends in Oil and Gas Investments

The oil and gas final investments market is in a constant state of flux, with trends emerging and evolving rapidly. Here are some of the key trends shaping the industry:

Impact of Global Politics on the Oil and Gas Final Investments Market

Geopolitical events have a significant impact on the oil and gas market. Conflicts in oil-producing regions, trade disputes, and international agreements can all affect the price and supply of oil and gas. For example, OPEC (Organization of the Petroleum Exporting Countries) plays a central role in regulating oil production and, consequently, the global oil price. Investors in the oil and gas market must closely monitor these geopolitical developments to anticipate market fluctuations and adjust their investment strategies accordingly.

How Technology is Shaping the Oil and Gas Final Investments Market

Technology has transformed the oil and gas industry, leading to increased efficiency and new investment opportunities. Here are some of the key technological advancements that are shaping the market:

Innovations in Oil and Gas Extraction and Refinement

Technological innovations have made it possible to extract oil and gas from previously inaccessible locations, such as deep-sea reserves and shale formations. Hydraulic fracturing, or "fracking," is one such technology that has revolutionized the industry, allowing for increased oil and gas production in regions like the United States.

Moreover, advancements in refining technology have improved the efficiency of processing crude oil into refined products, reducing costs and environmental impact. These innovations create new investment opportunities while also presenting challenges, such as regulatory scrutiny and environmental concerns.

Risks and Challenges in the Oil and Gas Final Investments Market

Investing in the oil and gas final investments market carries inherent risks. It's crucial to understand these risks to make informed investment decisions. Here are some of the key risks and challenges faced by the industry:

Environmental Concerns and Regulations

The oil and gas industry has faced increasing scrutiny due to its environmental impact. Issues such as greenhouse gas emissions, oil spills, and habitat destruction have led to stricter regulations and public outcry. As governments and organizations worldwide work to combat climate change, oil and gas companies must adapt to new environmental standards and reduce their carbon footprint.

Investors in the oil and gas market must consider these environmental risks and assess how companies are addressing them. Companies that proactively embrace sustainability and environmental responsibility may be better positioned for long-term success.

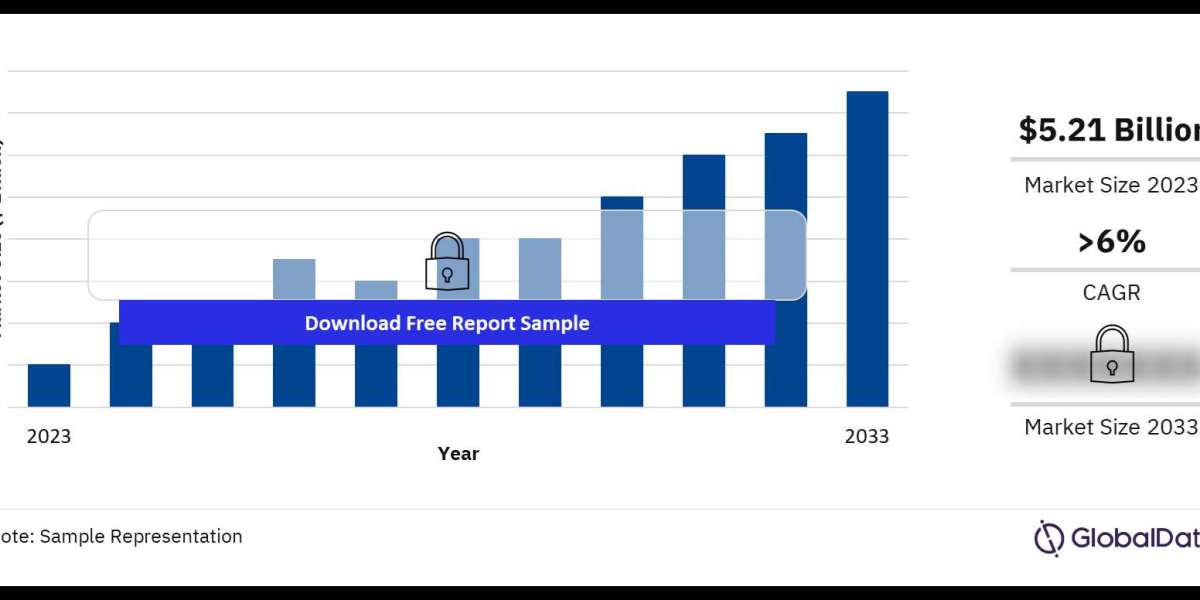

Buy the Full Report For more Insights into the Key Regions in the Upstream FIDs in 2024, Download a Free Sample Report