The concept of BNPL is straightforward: it allows consumers to make purchases and pay for them in installments over time, typically without incurring interest. Unlike traditional credit cards, which may charge high-interest rates and fees, BNPL services often tout transparency and affordability. This model appeals to consumers seeking budget-friendly options and greater control over their finances.

Several factors have contributed to the rapid expansion of the BNPL market. Firstly, the digitalization of commerce has facilitated the integration of BNPL solutions into online checkout processes, streamlining the purchasing experience for consumers. Moreover, the shift towards e-commerce, accelerated by the COVID-19 pandemic, has amplified the demand for flexible payment options, further fueling the adoption of BNPL services.

Key Players and Market Dynamics

The BNPL market is characterized by a diverse ecosystem of players, ranging from fintech startups to established financial institutions. Companies such as Afterpay, Klarna, Affirm, and PayPal's Pay in 4 have emerged as frontrunners in this space, leveraging innovative technology and strategic partnerships to capture market share.

One of the primary drivers of the BNPL market's growth is its appeal to millennials and Gen Z consumers, who prioritize convenience and financial flexibility. These demographic segments, accustomed to digital solutions and wary of traditional credit, have embraced BNPL as a preferred method of payment for both online and in-store purchases.

Furthermore, the pandemic-induced economic uncertainty has prompted consumers to seek alternative payment options that align with their budgetary constraints. BNPL services offer a lifeline to individuals facing financial constraints by allowing them to spread out payments over time, thereby reducing the immediate financial burden of large purchases.

Challenges and Regulatory Scrutiny

Despite its meteoric rise, the BNPL industry faces several challenges, including concerns about consumer debt and regulatory scrutiny. Critics argue that the ease of BNPL transactions may encourage impulse spending and contribute to financial irresponsibility among consumers, particularly those prone to overspending.

Moreover, regulatory authorities have started to scrutinize the BNPL market's practices, calling for increased transparency and consumer protection measures. In response, industry players have committed to implementing responsible lending practices, such as affordability checks and clear disclosure of terms and conditions, to mitigate the risk of consumer harm.

Future Outlook

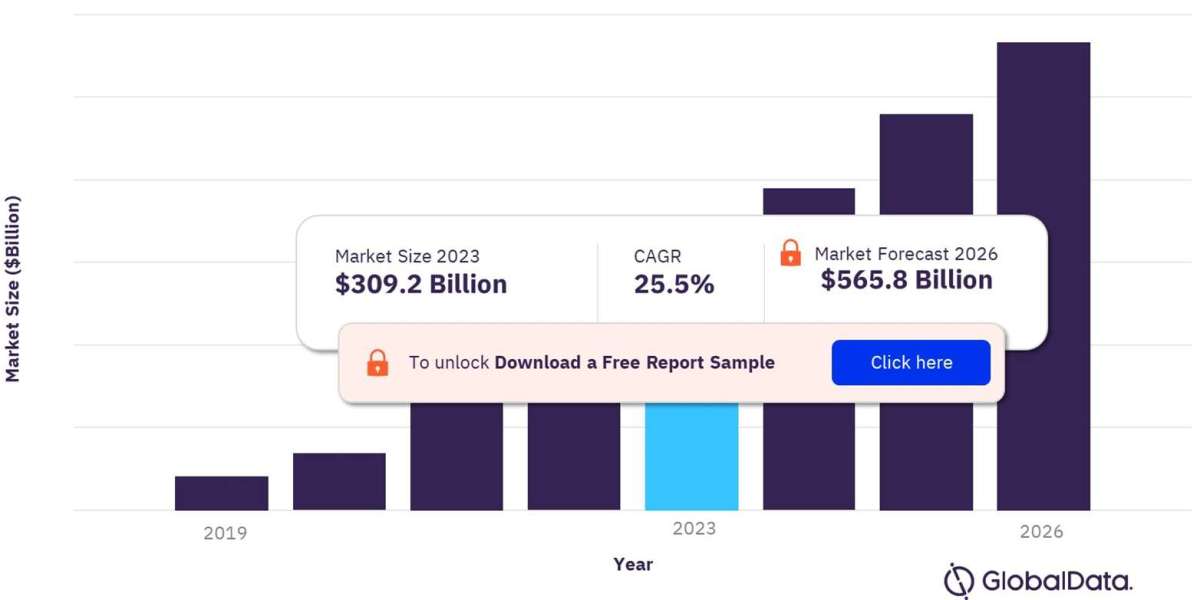

Looking ahead, the BNPL market shows no signs of slowing down, with continued innovation and expansion on the horizon. As consumers increasingly gravitate towards digital payment solutions and demand greater flexibility in their purchasing journey, BNPL services are poised to become a staple of the retail landscape.

However, sustaining this growth will require industry players to navigate regulatory challenges effectively and uphold best practices in responsible lending. By prioritizing transparency, consumer protection, and financial education, the BNPL market can continue to thrive while empowering consumers to make informed financial decisions.

View Sample Report for Additional Insights on the BNPL Market Forecast, Download a Free Report Sample