As one of the sunniest countries in the world, Mexico possesses abundant solar resources, making solar energy an attractive option for both residential and commercial consumers. This article delves into the dynamics of Mexico's solar PV market, exploring its evolution, current state, and future prospects.

Evolution of Solar PV in Mexico: The journey of solar PV in Mexico can be traced back to the early 2000s when the government began implementing renewable energy policies to diversify the country's energy mix and reduce dependence on fossil fuels. The introduction of the Ley del Servicio Público de Energía Eléctrica (Public Electricity Service Law) in 1992 laid the groundwork for the development of renewable energy projects, including solar.

In 2007, Mexico launched the Special Program for Renewable Energy (PEM) with the goal of increasing the share of renewable energy in electricity generation. Subsequent energy reforms and regulatory frameworks, such as the General Climate Change Law of 2012 and the Energy Transition Law of 2015, further bolstered the solar PV sector by providing incentives and establishing targets for clean energy deployment.

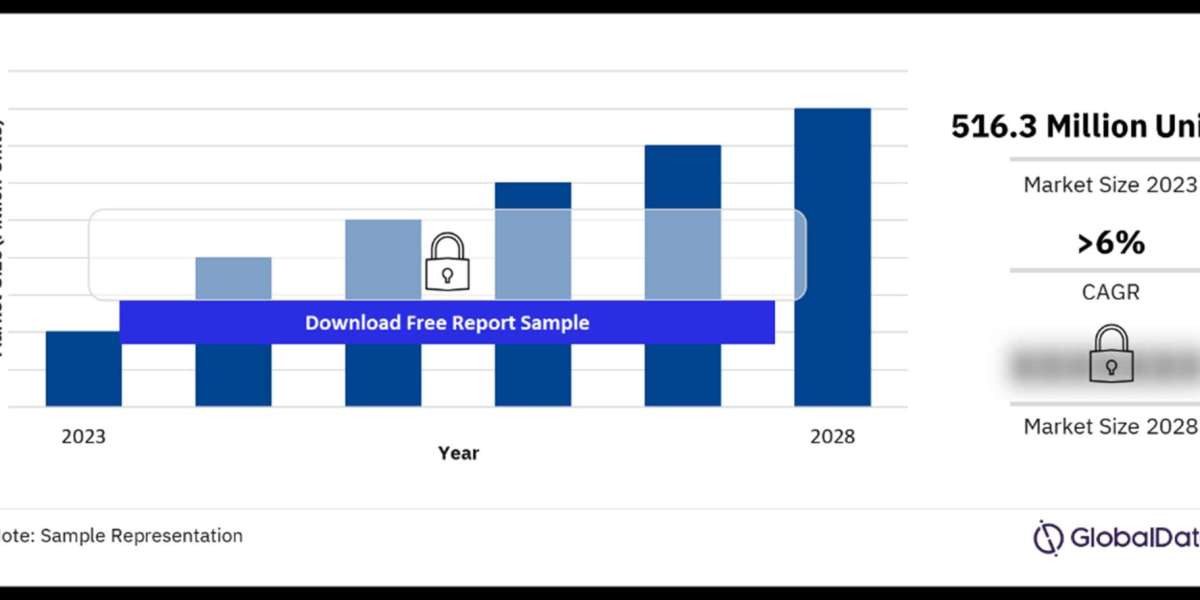

Current Landscape: Today, Mexico stands as one of the fastest-growing solar PV markets in Latin America. The country boasts an installed solar capacity of over 6 gigawatts (GW) as of [current year], with both utility-scale and distributed generation projects contributing to this growth. Utility-scale solar parks, often located in regions with high solar irradiance like the northern states of Sonora and Chihuahua, have significantly expanded Mexico's solar capacity.

Furthermore, the residential and commercial sectors are increasingly adopting rooftop solar systems, encouraged by net metering policies that allow consumers to offset their electricity bills with excess solar generation. This distributed generation model not only reduces electricity costs for consumers but also contributes to grid stability and resilience.

Key Players and Investments: Several key players have emerged in Mexico's solar PV market, including domestic and international developers, EPC (engineering, procurement, and construction) companies, and financial institutions. Companies like Enlight, Atlas Renewable Energy, and Gauss Energía have been instrumental in developing large-scale solar projects across the country, leveraging Mexico's favorable regulatory environment and abundant solar resources.

Moreover, significant investments from international entities have flowed into Mexico's solar sector, attracted by the country's growing market potential and supportive policies. These investments encompass project financing, technology partnerships, and joint ventures aimed at expanding solar infrastructure and fostering local industry growth.

Challenges and Opportunities: Despite its rapid expansion, Mexico's solar PV market faces certain challenges, including intermittency issues, grid integration constraints, and regulatory uncertainties. Additionally, the COVID-19 pandemic disrupted supply chains and project timelines, posing temporary setbacks to the sector's growth trajectory.

However, these challenges are accompanied by abundant opportunities. Continued technological advancements, such as energy storage solutions and grid modernization technologies, hold the promise of addressing grid integration challenges and enhancing the flexibility and reliability of solar power. Furthermore, ongoing policy initiatives, including auctions for renewable energy contracts and incentives for distributed generation, will further stimulate investment and innovation in the sector.

Future Outlook: The future of Mexico's solar PV market appears bright, with forecasts suggesting continued expansion and maturation. The country's ambitious renewable energy targets, including a goal of generating 35% of electricity from clean sources by 2024 and 50% by 2050, will drive further investments in solar and other renewable technologies.

For More Information on Mexico’s Renewable Energy Policy Framework, Download A Free Report Sample