Transforming Economies: The Digital Payment Revolution

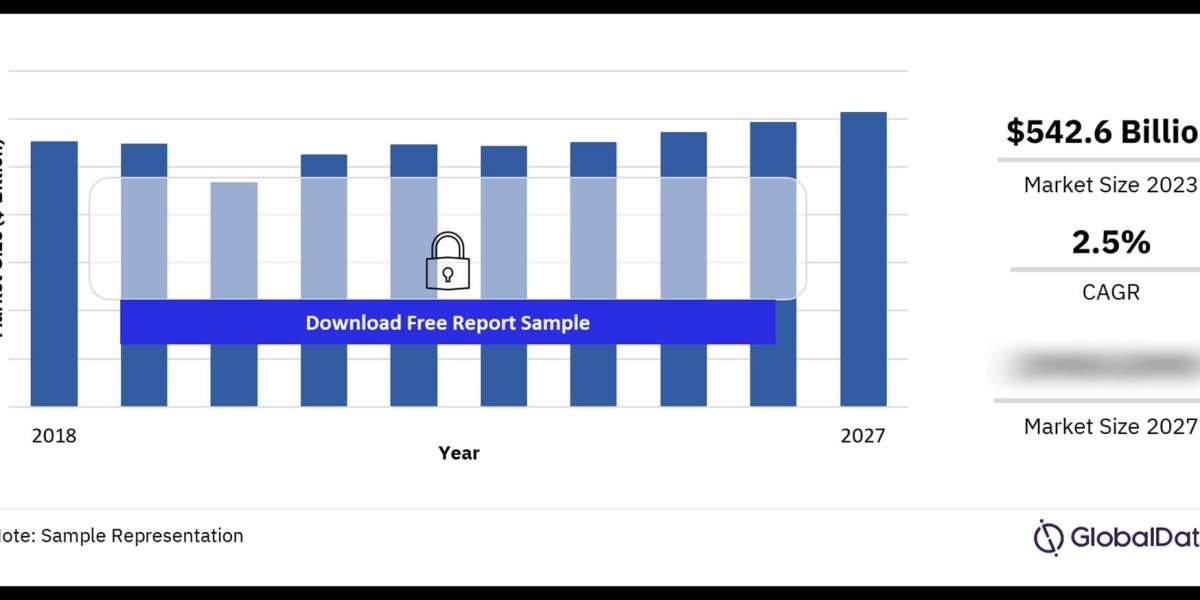

The digital payment landscape, valued at USD 82.97 billion in 2022, is projected to soar to USD 285.37 billion by 2029, marking a remarkable 19.3% CAGR during 2023-2029. This surge is attributed to the ever-evolving methods of financial transactions that don't involve physical currency exchanges, shaping a new era of electronic payments.

Understanding Digital Payments

Digital payments epitomize transactions conducted through various online channels, eliminating the need for physical currency exchange. From smartphones to cards, these transactions occur between parties possessing bank accounts, digital devices, and an established medium for electronic transfers.

The Unified Payments Interface (UPI) emerges as a trailblazer in this arena, having witnessed transactions exceeding a staggering USD 1 trillion in value. Its popularity underscores the widespread adoption and reliance on digital transactions.

Digital Payment Market Extent and Perspectives:

The Global Digital Payment Market report is a reservoir of statistical and analytical insights providing a holistic understanding of market size, share, growth, trends, demand, key players, industry summaries, opportunities, value cycles, end-users, technology, types, and applications. It meticulously analyzes micro market opportunities for stakeholders, while also scrutinizing the competitive landscape and product offerings of major industry players.

Advantages Galore: Why Go Digital?

The shift towards digital payments presents a plethora of advantages, especially for small businesses. Enhanced speed, security, and reduced risks or fees make it an appealing choice for both consumers and enterprises. Digital transactions mitigate risks through additional validation methods like biometric authentication, providing an extra layer of security.

Cashless transactions transform commercial interactions, streamlining operations, enhancing customer experiences, and simplifying accounting with transparent, easily traceable records.

Digital Payment Market Dividing:

Segment-wise analysis unveils intriguing facets of this market. Payment processing solutions dominate, amplifying seamless checkout experiences for online shoppers. Point-of-sale systems reign supreme, offering swift transactions and varied payment options, revolutionizing in-store payments.

Meanwhile, net banking experiences rapid growth due to its time efficiency and rising internet penetration. On-premise deployment provides control and security, resonating with organizations seeking robust digital payment solutions.

by Technology

BEV

PHEV

HEV

According to the solution, with around 25.0% of worldwide revenue, the payment processing sector led the digital payment market in 2022. With more and more people choosing to purchase online, retailers are implementing payment processing solutions to give customers a smooth checkout experience. In order to increase their market share, companies that offer payment processing services are pursuing partnerships and mergers. PayU, for instance, expanded its presence in Singapore by acquiring Red Dot Payment, a supplier of payment solutions, in July 2019.

by Product

Hatchback

Sedan

SUV

Others

In terms of payment method, the point-of-sale sector led the digital payment market in 2022, bringing in over 52.0% of total revenue. Point of sale systems are the ones that retail firms use to handle transactions. Several payment alternatives, quick checkout selections, and customized customer service are all benefits of utilizing a point of sale. The point-of-sale payment technique is utilized by several retailers and eateries to enhance the payment experience for their patrons. For instance, in January 2020, the online meal delivery service Grubhub announced a collaboration with point-of-sale system developer ParTech Inc. to include point-of-sale technology into its ordering procedure.

by Battery

LFP

Li-NMC

Others

With over 60.0% of worldwide revenue, the major businesses segment led the digital payment market in 2022 based on enterprise size. Because of the high foot traffic in large retail establishments, digital payment solutions are required for speedy checkouts. Digital payment systems that enable a range of digital payment methods, including smart banking cards, point of sale, and e-wallets, allow customers to experience a more seamless checkout procedure. Businesses are attempting to offer consumers cutting-edge payment choices at the same time. For instance, Klarna announced a collaboration with after pay in October 2020 to provide Buy Now Pay Later services to its online clientele.

by Battery Capacity

>201 Ah

<201 Ah

by End-User

Shared mobility providers

Government organizations

Personal users

Others

End-user revenue-wise, the BFSI sector led the market in 2022, accounting for over 23% of worldwide revenue. Remittance expansion to low- and middle-income countries is expected to be one of the main drivers of new market development opportunities throughout the projection period. Banks are also improving their ability to compete with companies like Google, Amazon, and Facebook that provide digital payment solutions. To make things simpler for its customers, Bank of America, for instance, introduced a digital debit card in June 2019.

Get a free sample copy by asking. (To Gain a Comprehensive Understanding of the [Summary + TOC]] Structure of This Report) @: https://www.maximizemarketresearch.com/request-sample/16835

Decision Support through Data:

Qualitative and quantitative data presented in this market study empowers decision-makers to discern high-growth market segments and regions, grasp the influencing market factors, and identify key areas of opportunity. Moreover, it offers an extensive view of the competitive landscape, highlighting emerging trends within the Digital Payment market.

Digital Payment Important Market Participants:

1. Total System Services, Inc. 2. Wirecard AG 3. Novetti Group Limited 4. PayPal Holdings Inc. 5. ACI Worldwide Inc. 6. Adyen N.V. 7. Aurus 8. Aliant Payments 9. Alipay 10. Apple Pay 11. Dwolla 12. FattMerchant 13. FIS 14. Fiserv 15. Global Payments 16. Intuit 17. JPMorgan Chase 18. Mastercard 19. PayPal 20. Paysafe 21. PayTrace 22. PayU 23. Spreedly 24. Square 25. Stripe 26. Visa 27. WEX 28. Worldline 29. 2Checkout

For instant access, download your exclusive sample copy of the report right now!

Digital Payment Market Area-Specific Analysis:

Across continents, North America leads, leveraging technology in various sectors like smart parking, while Europe witnesses growth driven by collaborative initiatives in digital payments. The Asia-Pacific region, with China at the forefront, marks a swift rise due to widespread digital wallet usage, especially in e-commerce and point-of-sale payments.

The region's diverse markets, from mature economies like Japan and South Korea to burgeoning digital payment landscapes in India and China, showcase varying adoption rates and preferred payment methods.

Section Heading: Digital Payment Market

Part 01: Executive Summary

Part 02: Scope of the Digital Payment Market Report

Part 03: Digital Payment Market Landscape

Part 04: Digital Payment Market Sizing

Part 05: Digital Payment Market Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Major Things :

- Market Share, Size, and Forecast by Revenue|2022-2029

- Market Dynamics: Growth drivers, Restraints, Investment Opportunities, and Key Trends

- Market Segmentation: A Detailed Analysis by Digital Payment

- Landscape Analysis: Leading key players and other prominent industry figures.

Our Top-Rated Trending Articles:

Succinic Acid Market https://www.maximizemarketresearch.com/market-report/global-succinic-acid-market/25839/

Nuclear Power Market https://www.maximizemarketresearch.com/market-report/nuclear-power-market/73334/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656