The insurance landscape in Uganda has witnessed significant growth and transformation over the years. From its historical evolution to the current market dynamics, the Uganda insurance sector plays a pivotal role in the country's economic development.

Introduction

Insurance is a crucial component of financial stability and risk management, providing individuals and businesses with a safety net against unforeseen events. In Uganda, the insurance market has become an integral part of the financial sector, contributing to the overall economic resilience of the nation.

Historical Evolution

The journey of the

Uganda insurance market has been marked by noteworthy milestones and changes. From the establishment of the first insurance companies to the liberalization of the sector, each phase has shaped the industry into what it is today.

Current Landscape

As of today, the Uganda insurance market is a dynamic sector with various players offering a range of insurance products and services. Key players, including both local and international companies, contribute to the market's vibrancy and competitiveness.

Types of Insurance

The diversity of insurance products available in Uganda caters to different needs. Life insurance, health insurance, property insurance, and motor insurance are among the key categories, each serving a unique purpose in the market.

Regulatory Framework

Government regulations and policies govern the functioning of the insurance sector in Uganda. Regulatory bodies play a crucial role in overseeing compliance and ensuring fair practices within the industry.

Challenges Faced

Despite its growth, the Uganda insurance market faces challenges such as low insurance penetration, fraud, and public trust issues. Industry players are actively working to address these challenges and enhance the market's overall resilience.

Emerging Trends

Technological advancements have brought about innovative changes in the insurance sector. From digital platforms to data analytics, these trends are shaping the way insurance is bought, sold, and managed in Uganda.

Role of Insurance in Economic Development

The insurance market's contributions to Uganda's economy go beyond risk mitigation. By supporting businesses, providing financial security, and encouraging investments, insurance plays a crucial role in fostering economic growth.

Customer Awareness and Education

Increasing public awareness about the benefits of insurance is a priority for the industry. Education initiatives aim to empower individuals and businesses with knowledge about the importance of having insurance coverage.

Comparison with Global Insurance Markets

Contrasting the Uganda insurance market with global trends reveals unique characteristics and challenges. Learning from global experiences can provide insights into improving the efficiency and effectiveness of the local insurance industry.

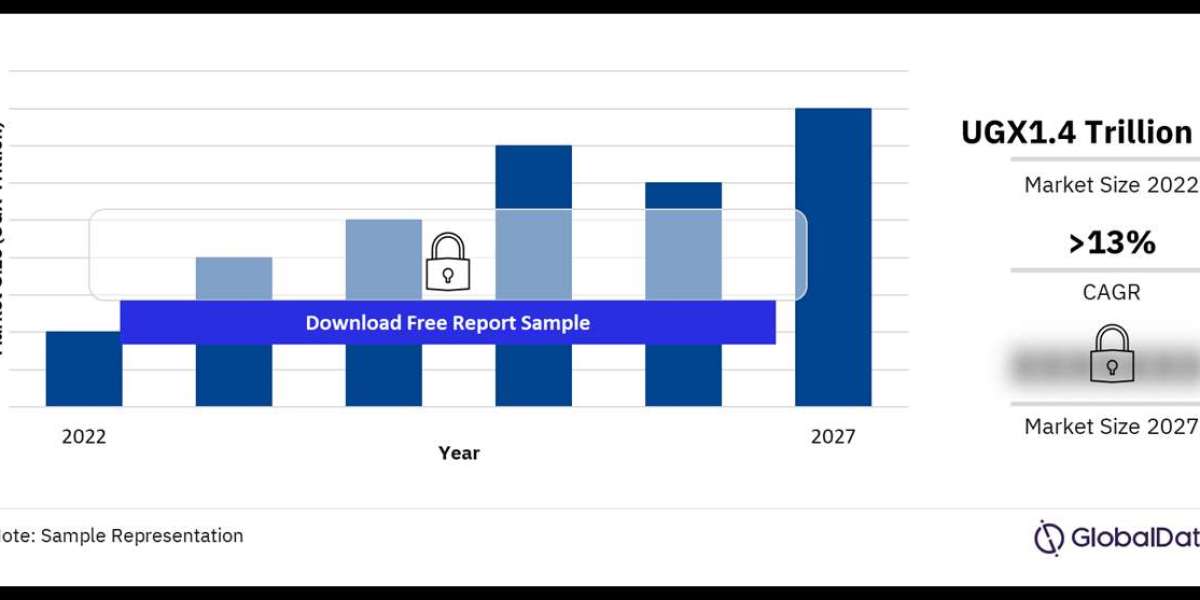

Future Outlook

Predicting the future of the Uganda insurance market involves assessing potential growth areas and addressing emerging challenges. Industry experts foresee continued expansion and evolution in response to changing economic and societal landscapes.

Case Studies

Examining successful insurance stories in Uganda highlights the positive impact of insurance on individuals and businesses. Real-life examples showcase the tangible benefits of having comprehensive insurance coverage.

Social Impact of Insurance

Beyond economic contributions, insurance has a significant social impact. Initiatives by insurance companies aimed at community welfare and social responsibility underscore the industry's commitment to making a positive difference.

Interviews with Industry Experts

Insights from key figures in the Uganda insurance sector provide a deeper understanding of the current state and future prospects. Interviews with industry leaders shed light on the challenges and opportunities shaping the insurance landscape.

Conclusion

In conclusion, the Uganda insurance market stands at the intersection of opportunity and challenge. As it continues to evolve, the sector's impact on economic development, social welfare, and individual well-being becomes increasingly evident. Exploring the diverse facets of the insurance market in Uganda reveals a resilient industry with the potential to navigate complexities and contribute significantly to the nation's growth.

AC Malta - Stay Cool and Comfortable with DL Group's Air Conditioning Solutions

By dlgroupmalta

AC Malta - Stay Cool and Comfortable with DL Group's Air Conditioning Solutions

By dlgroupmalta Maximizing Crop Potential: The Benefits of METROP Concentrate Liquid Foliar Fertilizer

By metropstores

Maximizing Crop Potential: The Benefits of METROP Concentrate Liquid Foliar Fertilizer

By metropstores Discover Excellence in 3D Printing - Buy Creality 3D Printer at WOL3D Coimbatore

Discover Excellence in 3D Printing - Buy Creality 3D Printer at WOL3D Coimbatore

A Convenient Way to Fix MetaMask Login Connection Issue

By rosekxffsf

A Convenient Way to Fix MetaMask Login Connection Issue

By rosekxffsf What is Satta Matka?

What is Satta Matka?