Introduction

In the dynamic landscape of global finance, insurance plays a pivotal role in ensuring economic stability. Uzbekistan, with its rich history and economic growth, has seen a significant evolution in its insurance market. Understanding the nuances of this market is crucial for both industry insiders and the general public.

Historical Perspective

The insurance sector in Uzbekistan has undergone a remarkable transformation over the years. From its nascent stages to the current sophisticated market, the journey has been marked by key milestones and robust regulatory developments. These changes have not only shaped the industry but have also contributed to its resilience.

Types of Insurance Offered

The Uzbekistan insurance market encompasses various types of insurance, catering to the diverse needs of the population. Life insurance, property and casualty insurance, health insurance, and auto insurance are among the key offerings. Each plays a unique role in safeguarding individuals and businesses from unforeseen circumstances.

Major Players in the Uzbekistan Insurance Market

Leading the charge are prominent insurance companies that dominate the market. A closer look at their market share provides insights into the competitive landscape, showcasing the strength and influence of these entities. Understanding the major players is essential for gauging the market's overall health.

Regulatory Framework

To maintain integrity and protect consumers, Uzbekistan has a robust regulatory framework governing the insurance sector. This section delves into the intricacies of insurance regulations and highlights the compliance requirements that insurers must adhere to. A transparent and regulated environment is crucial for fostering trust.

Market Trends and Innovations

In an era of rapid technological advancement, the insurance sector in Uzbekistan is not immune to innovation. Technological solutions and changing consumer preferences are reshaping the industry. Staying abreast of these trends is vital for companies looking to remain competitive and meet evolving customer expectations.

Challenges and Opportunities

No market is without challenges, and Uzbekistan's insurance sector is no exception. Identifying and addressing these challenges is key to sustained growth. Simultaneously, opportunities abound for those willing to innovate and adapt. Navigating this landscape requires a strategic approach.

Impact of Global Events

The global economy's ebb and flow have a direct impact on local markets, and Uzbekistan is no exception. Understanding how global events influence the insurance market provides valuable insights into its resilience and adaptability.

Consumer Awareness and Education

Despite the critical role insurance plays, consumer awareness is often lacking. This section explores the importance of educating consumers about the benefits of insurance and examines initiatives aimed at enhancing awareness. An informed consumer base is essential for the market's long-term success.

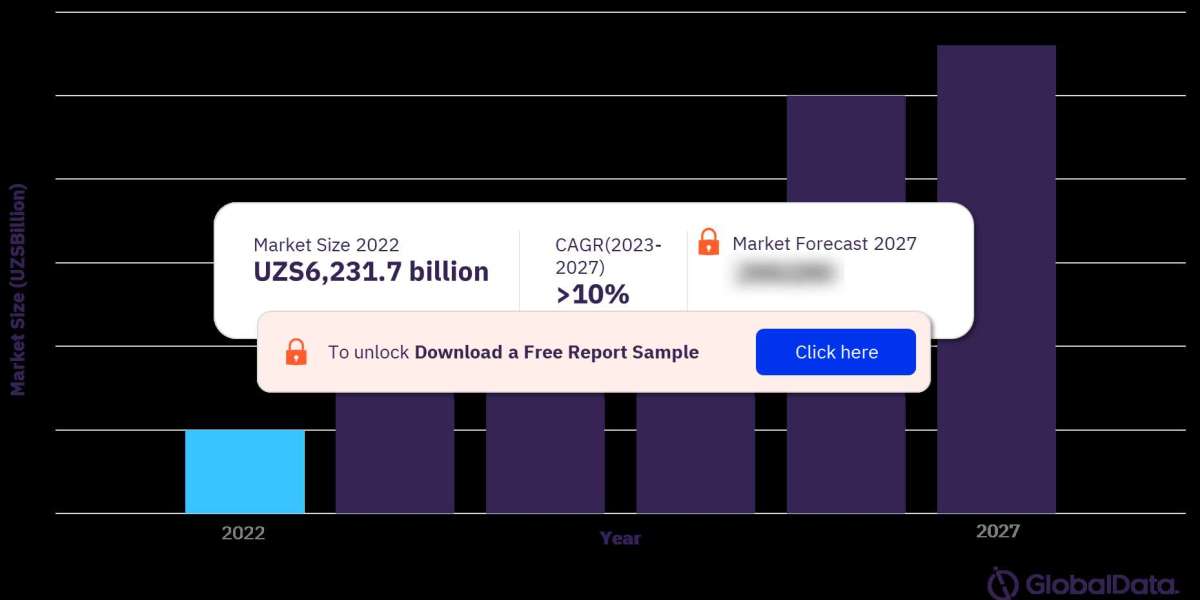

Future Outlook

Looking ahead, the Uzbekistan insurance market holds both promise and potential challenges. Predictions for the future, emerging trends, and areas for development are discussed in this section. Companies and consumers alike can use this information to make informed decisions.

Case Studies

Examining success stories within the Uzbekistan insurance market provides valuable lessons. These case studies highlight impactful initiatives and strategies that have contributed to the industry's growth. Learning from these experiences is instrumental in shaping future endeavors.

Expert Opinions

Insights from industry experts offer a well-rounded perspective on the current state and future trajectory of the Uzbekistan insurance market. Recommendations from these experts provide actionable strategies for companies looking to thrive in this dynamic environment.

Conclusion

In conclusion, the Uzbekistan insurance market is a dynamic and evolving landscape. Understanding its history, current state, and future prospects is essential for individuals, businesses, and policymakers. As the market continues to grow, adaptation and innovation will be key to sustained success.

For more insights into the Uzbekistan insurance market forecast, download a free report sample