The insurance market in Kyrgyzstan, like many others, faces a set of challenges and opportunities. Understanding these factors is crucial for insurers, regulators, and stakeholders to navigate the market effectively.

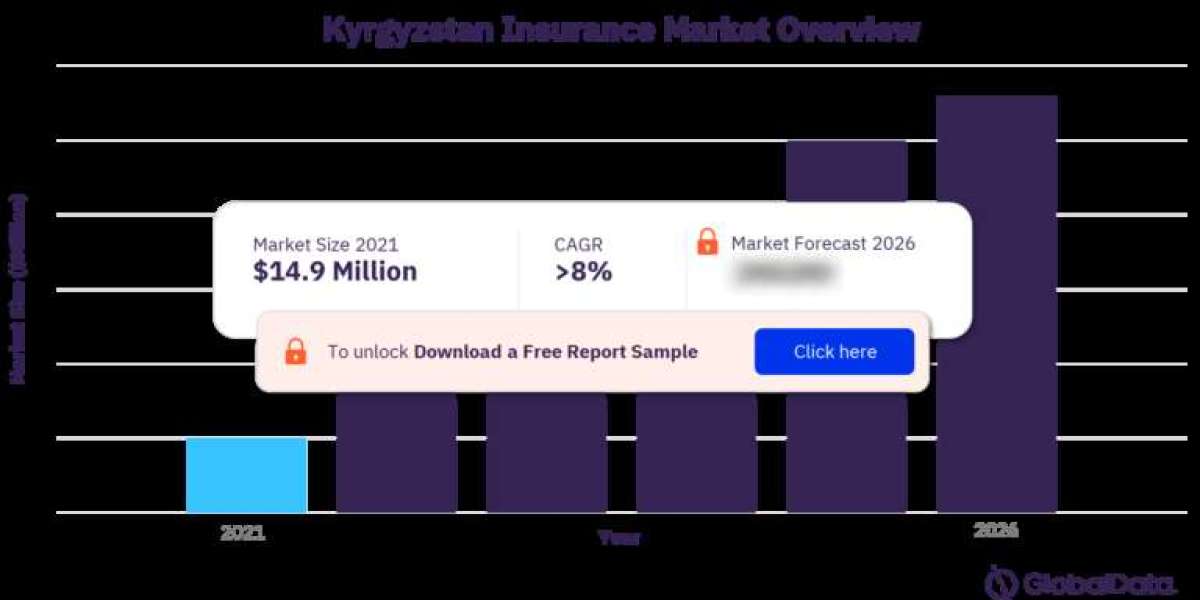

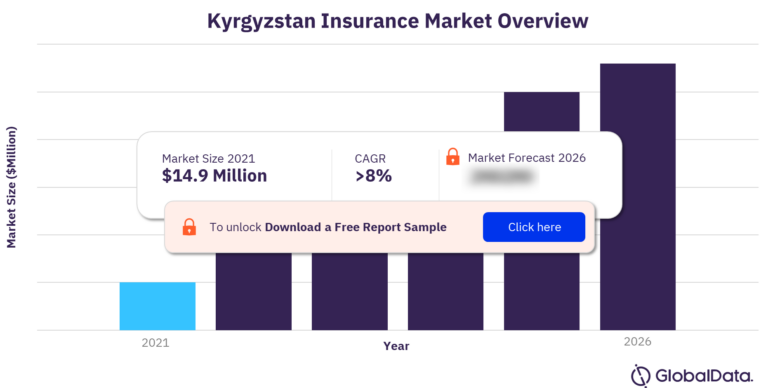

For more insights on this report, download a free report sample

Here's an exploration of the challenges and opportunities in the Kyrgyzstan insurance market:

Challenges:

Low Insurance Penetration:

- Challenge: Kyrgyzstan has traditionally had a low insurance penetration rate, indicating that a significant portion of the population is not covered by insurance.

- Implications: This poses a challenge for insurers to reach a wider customer base and highlights the need for awareness and education about the benefits of insurance.

Limited Awareness and Financial Literacy:

- Challenge: Limited awareness and low financial literacy among the population contribute to the underutilization of insurance products.

- Implications: Insurers face the challenge of educating the public about the importance of insurance, different types of coverage, and how insurance can provide financial security.

Economic Vulnerability:

- Challenge: Economic vulnerabilities, including fluctuations in income levels, can impact the affordability of insurance premiums for individuals and businesses.

- Implications: Economic uncertainties may lead to a hesitancy to invest in insurance, especially for discretionary coverages beyond mandatory requirements.

Regulatory Compliance and Supervision:

- Challenge: Ensuring regulatory compliance and effective supervision in the insurance sector is crucial for stability and consumer protection.

- Implications: Striking the right balance between encouraging market growth and ensuring regulatory oversight is a challenge for both regulators and insurers.

Catastrophic and Climate Risks:

- Challenge: The region may be prone to natural disasters and climate-related risks, requiring insurers to develop products that adequately address these concerns.

- Implications: Catastrophic events can lead to increased claims, and insurers must assess and manage risks associated with climate and natural disasters.

Fraud and Risk Management:

- Challenge: Like in many insurance markets, fraud and risk management are concerns that insurers need to address effectively.

- Implications: Developing robust risk assessment mechanisms and fraud detection measures is essential for maintaining the integrity of the insurance market.

Opportunities:

Market Expansion and Growth:

- Opportunity: There is room for market expansion and growth as insurance penetration increases, driven by economic development and rising awareness.

- Implications: Insurers can capitalize on this opportunity by introducing innovative products, leveraging technology, and reaching untapped customer segments.

Digitalization and Insurtech:

- Opportunity: The adoption of digital technologies and insurtech solutions presents an opportunity to enhance operational efficiency, reach customers through online channels, and streamline processes.

- Implications: Insurers can invest in digital platforms, mobile apps, and online services to improve customer experiences and increase market reach.

Government Initiatives:

- Opportunity: Collaborating with government initiatives to promote insurance awareness, financial education, and regulatory reforms can positively impact market growth.

- Implications: Insurers can actively engage with government programs aimed at enhancing the insurance ecosystem and improving consumer understanding.

Microinsurance for Inclusive Growth:

- Opportunity: Microinsurance initiatives can address the insurance needs of low-income and underserved populations, fostering inclusive growth.

- Implications: Developing affordable and tailored microinsurance products can create opportunities for insurers to expand their market presence.

Health Insurance Focus:

- Opportunity: The importance of health insurance has been emphasized globally, and there is an opportunity for insurers to offer comprehensive health coverage and wellness programs.

- Implications: With increasing health awareness, insurers can design health insurance products that cater to the specific needs of individuals and families.

International Partnerships:

- Opportunity: Collaborating with international insurers and reinsurers can bring expertise, risk management capabilities, and potentially lead to the introduction of new and sophisticated insurance products.

- Implications: International partnerships can enhance the credibility and competitiveness of local insurers.

Diversification of Product Offerings:

- Opportunity: Introducing diverse and innovative insurance products, including those addressing climate risks, can create new opportunities for revenue streams.

- Implications: Insurers can assess emerging risks and design products that resonate with evolving consumer needs.

Customer-Centric Approaches:

- Opportunity: Adopting customer-centric approaches, such as personalized offerings, improved customer service, and simplified insurance processes, can enhance customer satisfaction and loyalty.

- Implications: Focusing on the customer experience can differentiate insurers in a competitive market and attract a loyal customer base.

In summary, while challenges such as low insurance penetration and economic vulnerabilities persist, there are significant opportunities for growth in the Kyrgyzstan insurance market. Insurers that embrace digitalization, collaborate with stakeholders, and tailor their offerings to address specific market needs stand to benefit from the evolving landscape. Additionally, proactive engagement with regulatory reforms and international partnerships can contribute to the overall development of the insurance sector in Kyrgyzstan.