The Eswatini Insurance Industry is a dynamic sector that plays a crucial role in safeguarding individuals, businesses, and the nation's economy. In this comprehensive article, we will delve into the intricacies of this industry, explore its growth, and provide valuable insights into its workings. Let's embark on a journey to understand how Eswatini's insurance sector contributes to financial security and stability.

Eswatini Insurance Industry: A Closer Look

The Eswatini Insurance Industry, often referred to as the backbone of financial security, is characterized by its diverse range of services and products. This essential sector encompasses various insurance types, including life insurance, property and casualty insurance, and health insurance. Each of these sub-segments serves unique purposes, contributing to the overall well-being of Eswatini's citizens and businesses.

Understanding the Different Types of Insurance

Life Insurance: Protecting Your Loved Ones Life insurance provides a safety net for your loved ones in the event of your passing. It ensures that your family is financially secure and can cover expenses during a difficult time.

Property and Casualty Insurance: Safeguarding Your Assets Property and casualty insurance protect your assets, including your home and belongings. It provides compensation in case of damage or loss due to unforeseen events.

Health Insurance: Ensuring Your Well-being Health insurance is crucial for accessing quality healthcare. It covers medical expenses, ensuring that you and your family receive the best medical care when needed.

The Role of Eswatini Insurance Industry in the Economy

The Eswatini Insurance Industry is not just about financial protection; it also contributes significantly to the country's economic growth. Here are some ways in which this sector bolsters the nation's economy:

Risk Management: Insurance companies help individuals and businesses manage risks effectively, encouraging investment and entrepreneurship.

Job Creation: The industry generates employment opportunities, thereby reducing unemployment rates and contributing to the country's workforce.

Investment Opportunities: Insurance companies invest their reserves, promoting capital formation and economic development.

Long-term Planning: By providing long-term savings and investment options, the industry encourages financial planning and wealth accumulation.

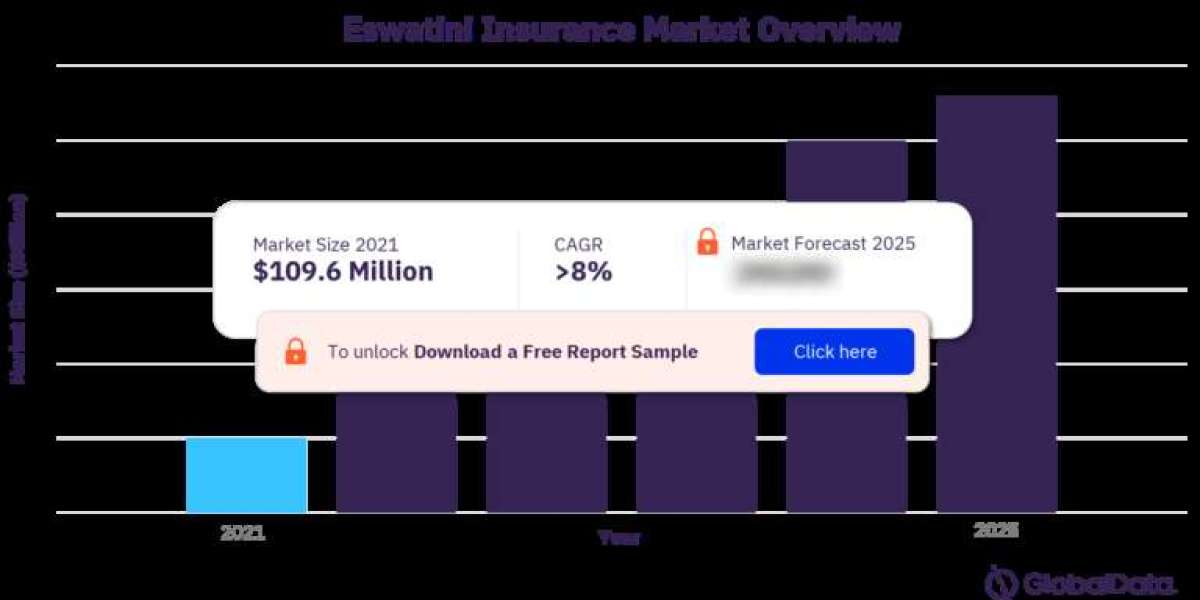

To gain more information on the Eswatini insurance market forecast, download a free report sample