Austria Life Insurance Market

The Essence of Life Insurance

Life insurance is more than just a financial product; it's a promise to protect your loved ones' future. When you invest in a life insurance policy, you provide a safety net that ensures financial stability in challenging times.

Types of Life Insurance

- Term Life Insurance: This type of policy provides coverage for a specific term and pays out a death benefit to beneficiaries. It's a cost-effective way to secure your family's future.

- Whole Life Insurance: Offering lifelong coverage, whole life insurance combines a death benefit with a savings component, allowing for cash value growth over time.

- Universal Life Insurance: This flexible option allows you to adjust your premiums and death benefit as your financial situation changes.

Why Choose Austria Life Insurance?

Austria's life insurance market is renowned for its stability and customer-centric approach. When you opt for life insurance in Austria, you can rest assured that your loved ones will be well taken care of in your absence.

The Benefits of Austria Life Insurance

Financial Security

Life insurance provides a safety net for your family, ensuring that they have the financial support they need in case of your untimely demise. It covers daily expenses, outstanding debts, and future financial goals.

Peace of Mind

Knowing that your loved ones are protected brings immense peace of mind. Life insurance allows you to live your life without the constant worry about what would happen to your family if something were to happen to you.

Estate Planning

Life insurance plays a crucial role in estate planning. It helps in the smooth transfer of assets to your heirs, reducing the burden of estate taxes.

Tax Benefits

In Austria, life insurance offers various tax benefits. The premiums you pay are often tax-deductible, and the payouts to beneficiaries are generally tax-free.

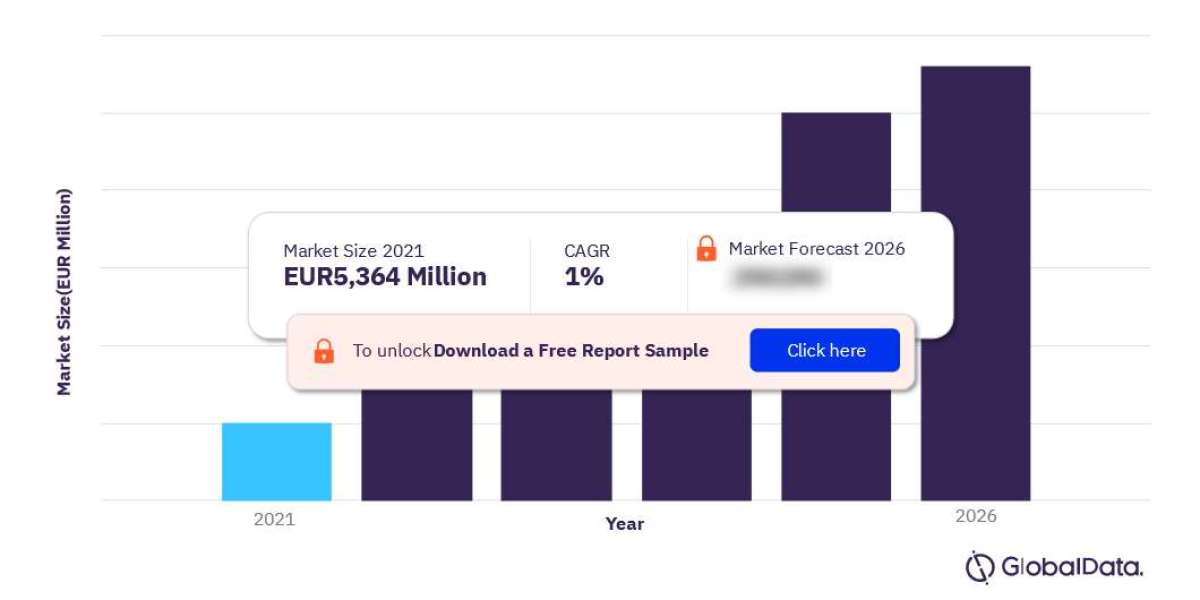

For more insights on Austria life insurance market forecast, download a free report sample