The future outlook for Thailand's general insurance market is influenced by various factors, including economic conditions, regulatory changes, technological advancements, and shifts in consumer behavior.

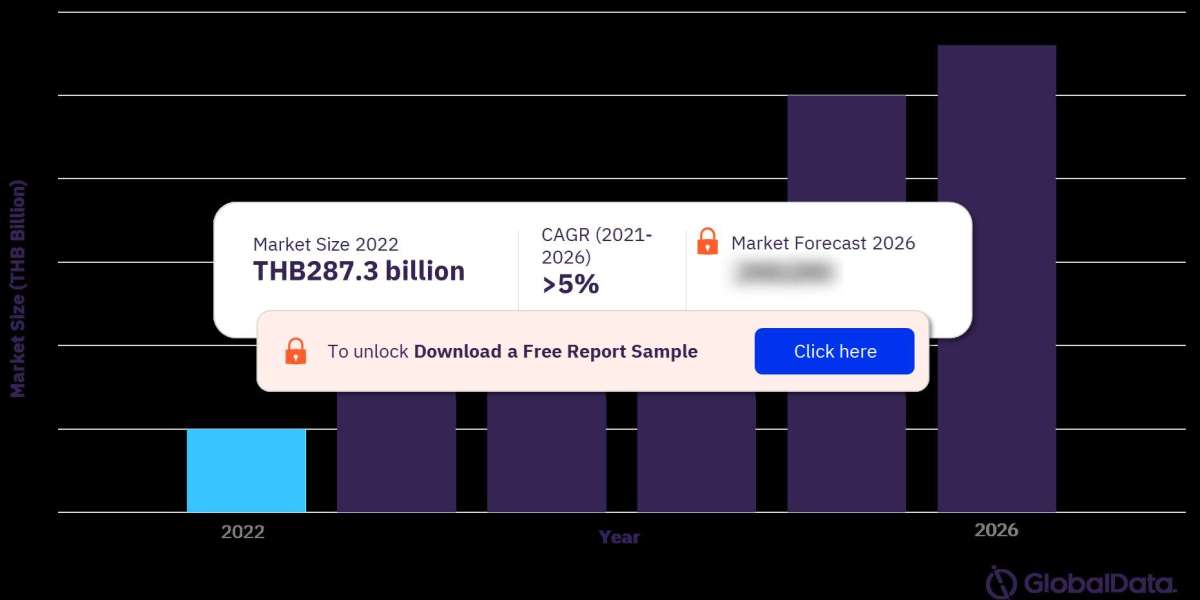

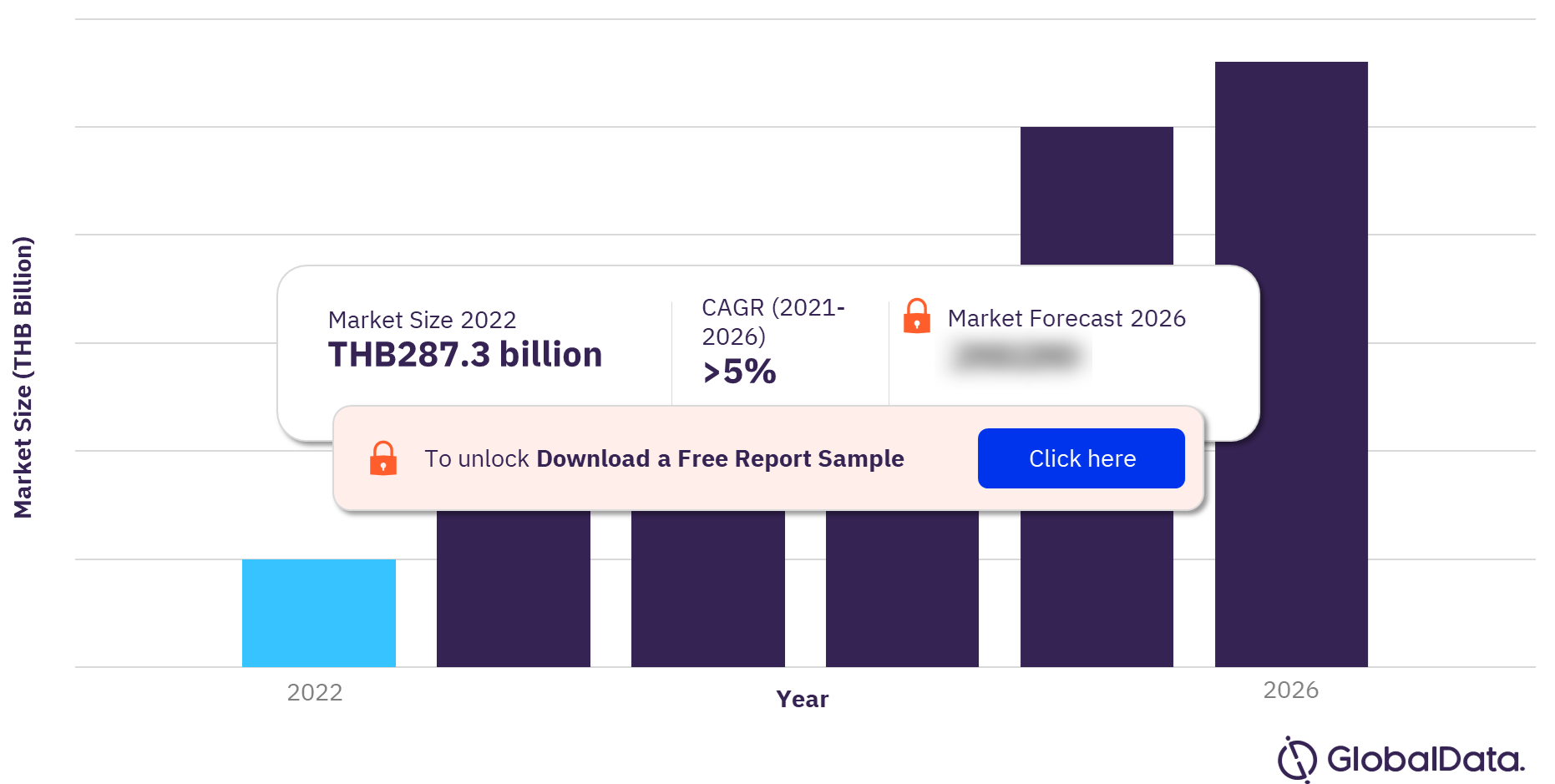

For more insights into the Thailand general insurance market, download a free report sample

Here are some growth prospects and trends to consider for Thailand's general insurance market:

1. Increasing Digitalization:

- The adoption of digital platforms and insurtech solutions is likely to continue. This will enhance the efficiency of insurance processes, from underwriting to claims management, and improve the overall customer experience.

2. Regulatory Reforms:

- Regulatory changes may influence the market. The Office of Insurance Commission (OIC) in Thailand has been active in implementing reforms to enhance the stability and competitiveness of the insurance industry.

3. Diversification of Offerings:

- General insurers in Thailand may expand their product offerings beyond traditional motor and property insurance. Health and medical insurance, as well as cyber insurance, are areas with growth potential.

4. Increased Awareness:

- Awareness of insurance and the importance of coverage is likely to rise. Public and private sector initiatives may contribute to this by promoting insurance literacy and coverage.

5. Economic Growth:

- Thailand's economic growth can boost demand for general insurance. As the economy expands, individuals and businesses may invest more in insurance to protect their assets and interests.

6. Risk Mitigation:

- The insurance market may see greater emphasis on risk mitigation and loss prevention. Insurers and businesses will work together to identify and reduce risks, thus minimizing potential claims.

7. Sustainability and ESG:

- Environmental, Social, and Governance (ESG) considerations are gaining importance in the insurance industry. Insurers may integrate ESG principles into their operations and investments.

8. Affinity Partnerships:

- Partnerships with various organizations, such as banks, retail outlets, and automotive dealers, can drive the distribution of insurance products, making them more accessible to consumers.

9. Health and Wellness Programs:

- Insurers may offer health and wellness programs to policyholders, encouraging a healthier lifestyle. This can lead to more personalized and data-driven underwriting.

10. Microinsurance: - Microinsurance products, tailored to the needs of low-income and underserved populations, may see increased adoption, driven by financial inclusion initiatives.

11. Insurtech Innovation: - Insurtech startups may introduce innovative solutions, such as parametric insurance and on-demand coverage, reshaping the insurance landscape in Thailand.

12. Pandemic Preparedness: - The COVID-19 pandemic has highlighted the importance of business interruption and pandemic insurance. Insurers may develop specialized products in response to this need.

13. Competition and Consolidation: - The general insurance market in Thailand is competitive. Consolidation and mergers among insurers may occur as companies seek to strengthen their market positions.

It's important to note that these predictions are subject to change based on economic, regulatory, and societal developments. The future of Thailand's general insurance market will be shaped by the ability of insurers to adapt to emerging trends and consumer needs, as well as their capacity to leverage technological innovations for improved customer service and risk management.