In today's fast-paced world, the banking industry is undergoing significant transformations. As technology advances and customer expectations evolve, staying ahead of the trends in the banking market is crucial. In this informative article, we'll explore the key developments in the banking sector. So, let's dive into the future of banking!

Introduction

The banking industry is no stranger to change, and staying informed about the latest trends is essential. In this article, we'll delve into various facets of the banking market, from technological innovations to sustainability initiatives. By the end of this journey, you'll be equipped with a comprehensive understanding of the trends shaping the future of banking.

Digital Transformation: Redefining Banking

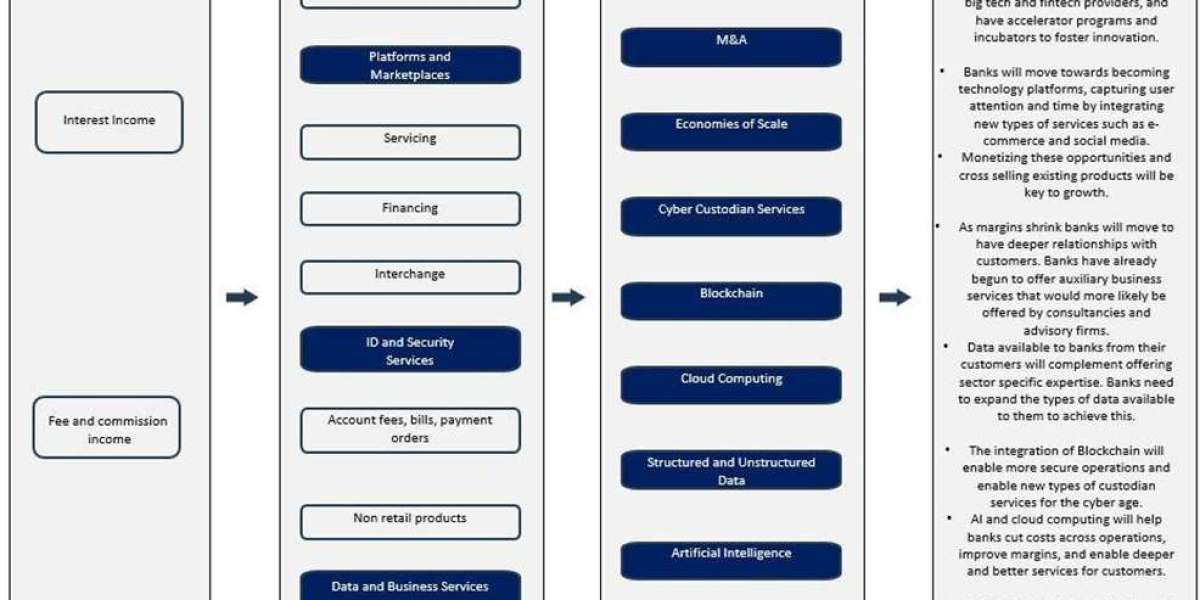

In this digital age, the banking landscape is experiencing a monumental shift toward digital transformation. Traditional brick-and-mortar branches are increasingly giving way to online services. Mobile banking apps, seamless online transactions, and AI-driven customer support are becoming the new norm. Banks are investing heavily in technology to enhance customer experiences, streamline operations, and boost security.

Sustainable Finance: A Growing Priority

Sustainability has become a buzzword in the banking industry. With growing concerns about the environment, banks are taking steps to promote sustainable trends in banking market finance. This trend includes green investments, responsible lending, and supporting eco-friendly initiatives. Ethical banking is on the rise, reflecting a broader commitment to a greener future.

Open Banking: A Revolution in Access

Open banking is redefining how customers access financial services. Through data sharing and collaboration among financial institutions, customers have access to a wider range of services and offerings. This trend promotes competition, empowers customers, and fosters innovation. The era of banking exclusivity is gradually coming to an end.

Cryptocurrency and Blockchain: The Future of Transactions

Cryptocurrency and blockchain technology have gained immense popularity in recent years. These innovations are poised to transform the way transactions are conducted. Banks are exploring the integration of digital currencies, and blockchain is revolutionizing security and transparency in financial operations. The potential for these technologies is limitless.

Personalization: Tailoring Banking Experiences

Customers today demand personalized banking experiences. Banks are leveraging data analytics to understand individual preferences and offer tailored solutions. From customized investment strategies to personalized loan options, personalization is enhancing customer satisfaction and loyalty.

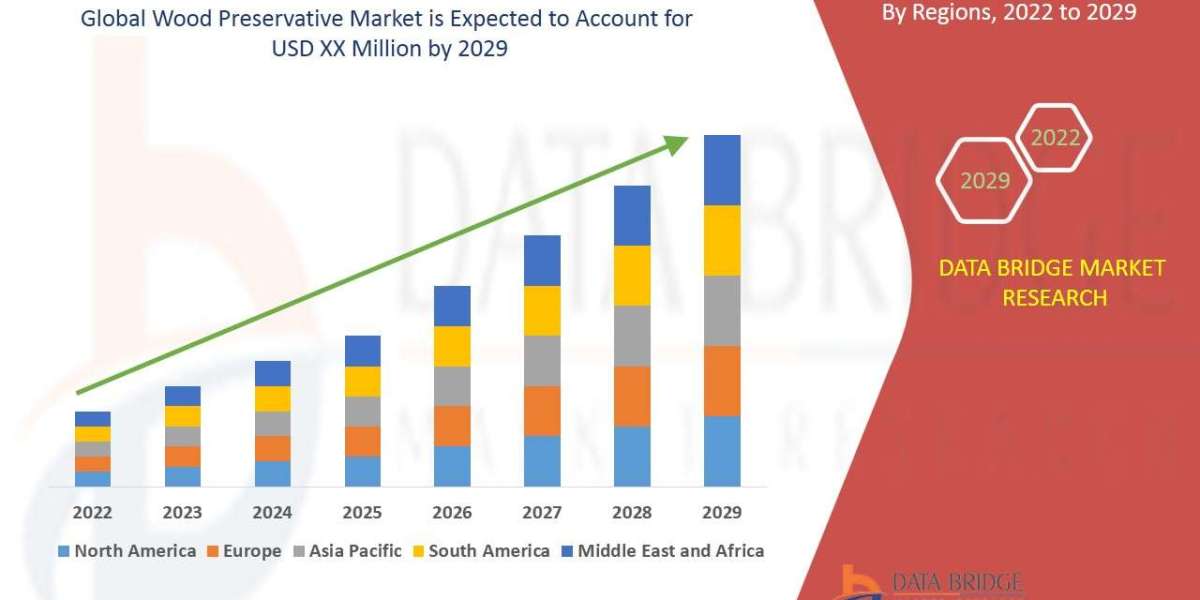

To gain more information about the banking sector forecast, download a free report sample