The wealth management sector plays a pivotal role in the world of finance, guiding individuals and organizations towards financial success. In this article, we delve into the Wealth Management Sector Market, offering a comprehensive analysis of current trends, emerging technologies, and the critical role it plays in optimizing financial strategies.

The Changing Landscape of Wealth Management

Evolution of Wealth Management

The wealth management sector has evolved significantly over the years. It has transitioned from traditional, transaction-based approaches to more holistic, client-centric strategies. Today, wealth management is about understanding individual financial goals and tailoring investment plans accordingly.

Technology-Driven Solutions

In the modern era, technology is at the forefront of wealth management. Robo-advisors and digital platforms have become integral tools in assisting wealth managers and clients in making informed decisions. These solutions offer real-time insights, portfolio optimization, and enhanced transparency.

Globalization of Investments

The wealth management sector is no longer confined to local markets. Globalization has opened up a world of opportunities, enabling clients to diversify their investments across international boundaries. This trend has fostered cross-border collaboration and the integration of global financial instruments.

Market Dynamics and Trends

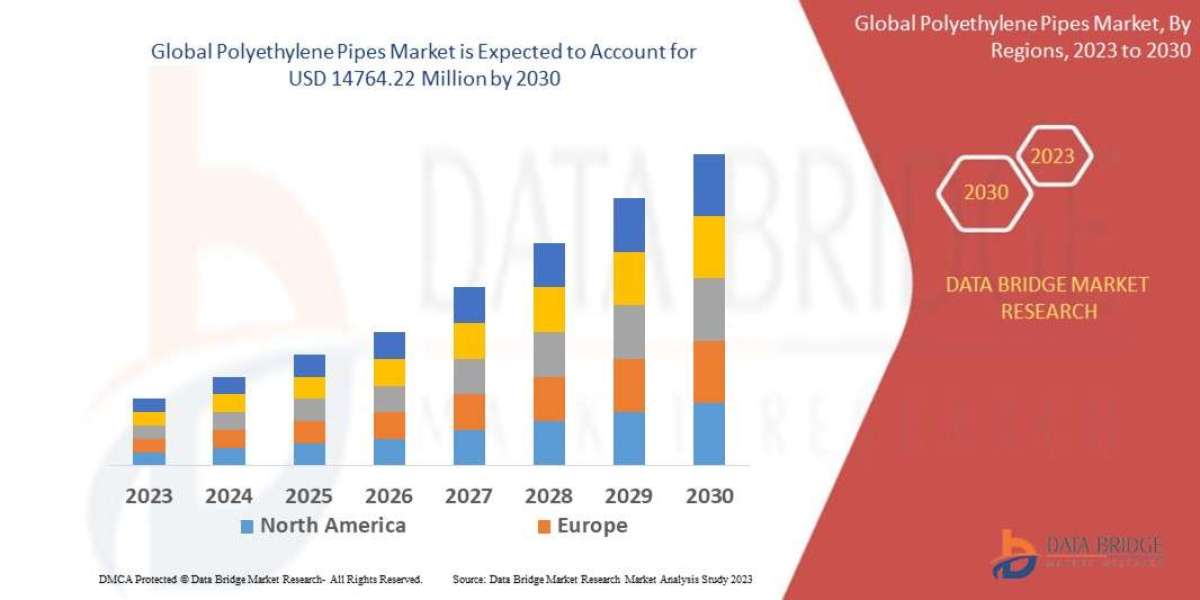

Market Growth

The Wealth Management Sector Market continues to experience steady growth, driven by factors such as increasing wealth accumulation, an aging population, and a growing emphasis on financial planning. Investors are seeking expertise to navigate complex financial landscapes.

Key Market Trends

Sustainable Investing: ESG (Environmental, Social, and Governance) investing has gained prominence, reflecting the increasing interest in responsible and ethical investments.

Digital Transformation: The industry is undergoing a digital transformation, with mobile apps and online platforms providing convenient access to financial information and services.

Personalization: Wealth managers are increasingly personalizing their services, tailoring investment portfolios to individual client needs and preferences.

The Role of Wealth Management

Client-Centric Approach

Wealth management revolves around a client-centric approach. Wealth managers assess a client's financial objectives, risk tolerance, and investment horizon to create a tailored financial plan. The aim is to optimize returns while managing risk effectively.

Investment Diversification

Diversification is a fundamental strategy in wealth management. By spreading investments across different asset classes, industries, and geographies, risk is mitigated, and the potential for long-term growth is enhanced.

The Future of Wealth Management

Technological Advancements

The future of wealth management will undoubtedly be shaped by technological advancements. Artificial intelligence, big data, and blockchain technology will further enhance data analysis, portfolio management, and security.

ESG and Sustainable Investments

The trend of sustainable investing is poised to continue, reflecting a growing awareness of social and environmental issues. Wealth managers will play a critical role in guiding clients towards responsible investments.

Fintech Integration

The integration of fintech into wealth management is set to redefine the industry. Fintech firms are collaborating with traditional wealth management companies to offer innovative solutions and services.

Conclusion

In conclusion, the Wealth Management Sector Market is a dynamic and evolving field, with technology, globalization, and personalized service at its core. As the industry adapts to meet the needs of clients, it continues to play a pivotal role in optimizing financial strategies, ensuring financial success for individuals and organizations.