The insurance market has witnessed a significant transformation with the adoption of cloud computing. While many established leaders dominate the field, there are also emerging players making a mark.

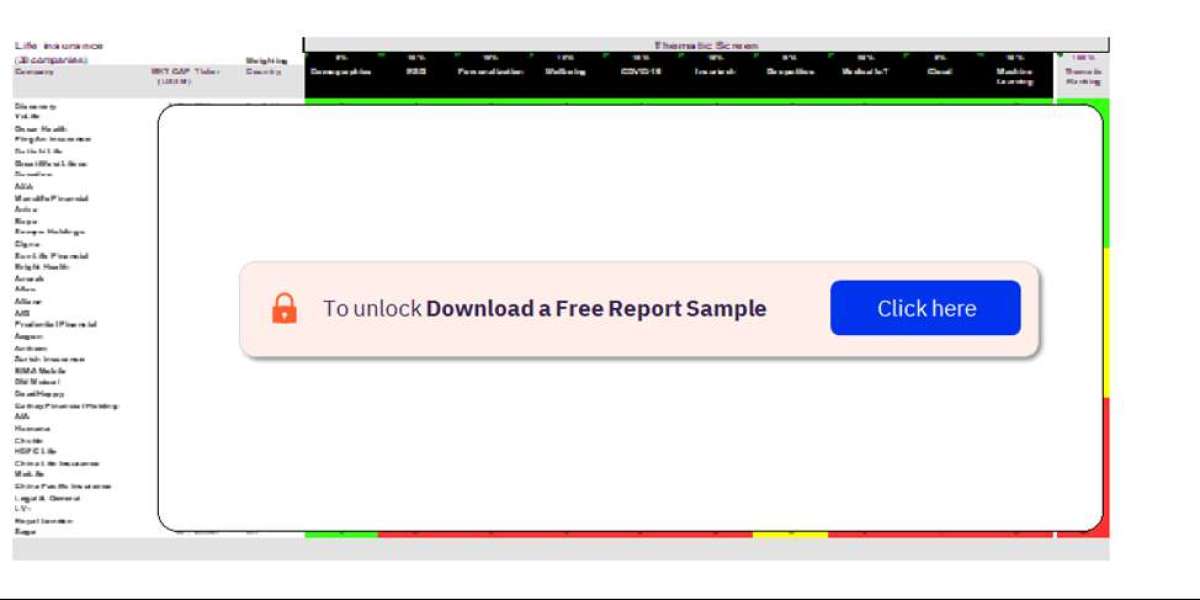

To know more about the sector scorecards, download a free report sample

Here's an overview of some of the market leaders and emerging players in the cloud computing space within the insurance industry:

Market Leaders:

Amazon Web Services (AWS): AWS is one of the leading cloud service providers globally. They offer a range of cloud solutions and services, making it a preferred choice for insurance companies looking for scalable and reliable cloud infrastructure.

Microsoft Azure: Azure is another major player in the cloud industry. It provides comprehensive cloud services, and many insurance companies leverage Azure's capabilities for data analytics, artificial intelligence, and machine learning.

IBM Cloud: IBM Cloud offers a wide array of cloud solutions, including hybrid and multicloud options. Insurance companies benefit from IBM's expertise in AI, data analytics, and blockchain technology.

Google Cloud: Google Cloud is known for its data analytics and machine learning capabilities. Insurance companies use Google Cloud for big data analysis, enhancing customer experiences, and improving underwriting processes.

Oracle Cloud: Oracle Cloud offers cloud infrastructure and applications tailored to the insurance sector. It is trusted by many insurers for its reliability and advanced database technologies.

Emerging Players:

Salesforce: Salesforce has been making inroads into the insurance industry with its cloud-based customer relationship management (CRM) and analytics solutions. It focuses on enhancing customer engagement and streamlining processes.

Lemonade: Lemonade, a technology-based insurance startup, relies on cloud computing to deliver its services. It has gained attention for its use of AI and automation in underwriting and claims processing.

Metromile: Metromile, another insurtech, employs cloud-based telematics and data analytics to offer pay-per-mile auto insurance. It's gaining popularity among urban drivers.

CoverHound: CoverHound is an online platform that offers insurance comparison and purchasing services. Its use of cloud technology simplifies the process of obtaining quotes and selecting insurance policies.

Hippo: Hippo Insurance is known for its smart home insurance products. They use cloud-based data analytics to assess property risks and offer customized coverage options.

Root Insurance: Root leverages cloud computing for usage-based auto insurance. Through mobile apps and telematics, they collect data to calculate insurance premiums.

These emerging players are often referred to as insurtech companies, as they combine insurance expertise with advanced cloud-based technologies to disrupt traditional insurance models. They focus on delivering personalized and data-driven insurance solutions, often with a strong emphasis on customer experience.

It's important to note that the cloud computing landscape in the insurance industry continues to evolve. Established leaders and emerging players will continue to shape the industry as they leverage the cloud to innovate and provide more efficient and customer-centric insurance services.