In today's unpredictable world, health is wealth, and it's never been more important to safeguard your financial future. Critical Illness Insurance Market is your lifeline when facing life-altering health challenges. In this comprehensive guide, we'll walk you through all the essential aspects of Critical Illness Insurance, providing you with the expertise and knowledge you need to make informed decisions.

Understanding Critical Illness Insurance

Critical Illness Insurance is a specialized form of coverage that provides financial protection when you're diagnosed with a severe medical condition. It offers a lump-sum payout, allowing you to focus on your recovery instead of worrying about medical bills and other expenses. Here's a closer look at what you need to know:

The Basics of Critical Illness Insurance

Critical Illness Insurance Market Explained

Critical Illness Insurance Market offers a safety net for individuals and families when facing a critical medical diagnosis. This coverage can be a game-changer, providing peace of mind during challenging times.

Key Features and Benefits

- Comprehensive Coverage: Critical Illness Insurance covers a wide range of illnesses, including cancer, heart disease, and stroke.

- Lump-Sum Payout: You'll receive a tax-free lump sum upon diagnosis, giving you financial flexibility.

- Additional Expenses: It can help with non-medical expenses, such as mortgage payments or childcare.

- Peace of Mind: Focus on your recovery without financial worries.

How Does Critical Illness Insurance Work?

Critical Illness Insurance market operates on a straightforward principle. When you're diagnosed with a covered condition and survive a waiting period, you'll receive a lump-sum payout. This payout can be used as you see fit, whether for medical bills, living expenses, or other financial needs.

Why Choose Critical Illness Insurance?

Critical Illness Insurance Market offers several compelling reasons to consider this coverage:

Financial Security

With the rising costs of healthcare, Critical Illness Insurance provides a vital financial safety net. It ensures that you can access top-notch medical care without worrying about the bills.

Flexibility

You have the freedom to use the lump-sum payout as you see fit. Whether it's medical treatments, home modifications, or a vacation to rejuvenate, the choice is yours.

Peace of Mind

Knowing that you have a financial cushion in place can reduce stress during an already challenging time. Focus on your recovery and well-being.

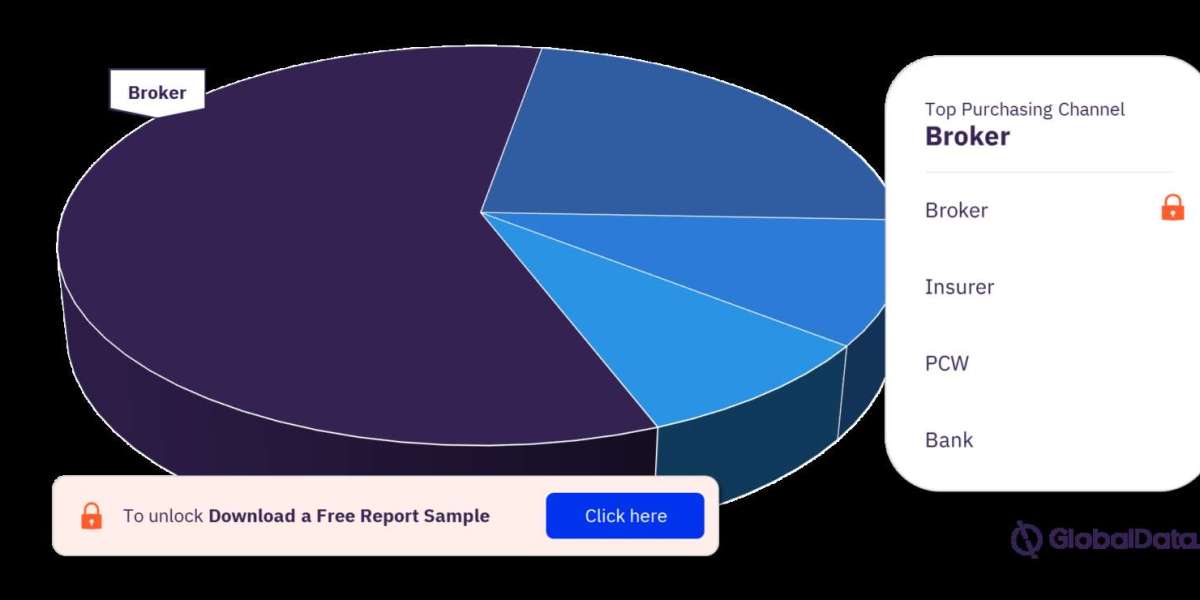

Buy full report for more purchasing channel insights as you download a free report sample