In an era where financial literacy is more vital than ever, Certified Financial Planner (CFP) certification is a hallmark of excellence and credibility in financial planning. At the heart of this prestigious certification are CFP courses, which equip aspiring financial planners with the knowledge and skills needed to navigate the complexities of modern finance. In this article, we explore how CFP courses empower the next generation of financial advisors, helping them guide clients to fiscal health and prosperity.

The Foundation of Financial Expertise

CFP courses are designed to transform financial professionals into trusted advisors. With a curriculum that encompasses critical aspects of financial planning—including retirement planning, estate planning, tax planning, and risk management—these courses are comprehensive and rigorous. They set the stage for a deeper understanding of finance, preparing candidates to craft sound financial strategies tailored to individual client needs.

The Pillars of CFP Courses

Comprehensive Knowledge

CFP courses cover a broad spectrum of financial planning components, from understanding investment vehicles to mastering the intricacies of tax law. This knowledge base is fundamental for financial planners who need to offer holistic advice to their clients.

Ethical Standards

A significant part of CFP courses is dedicated to ethics and professional conduct. Financial planners are entrusted with individuals' financial futures, and these courses instil the high ethical standards that are vital to this role.

Practical Application

CFP courses are not just about theory; they involve substantial practical training. This hands-on approach ensures that aspiring planners are well-equipped to apply their knowledge in real-world situations, providing invaluable experience before they even step into their professional roles.

The Road to Certification

Enrolling in CFP courses is the first step on the journey to becoming a Certified Financial Planner. This journey typically involves the following stages:

Education: Enroll in an approved program of CFP courses that cover the core principles of financial planning.

Examination: After completing the educational requirements, candidates must pass the CFP Certification Examination, which gauges their ability to implement financial planning knowledge in an integrated format.

Experience: Before becoming certified, candidates must acquire a certain amount of professional experience related to financial planning.

Ethics: Candidates must agree to adhere to high ethical and professional standards; this is a critical aspect that is rigorously emphasized throughout CFP courses.

Benefits of Completing CFP Courses

Enhanced Career Prospects

CFP certification, backed by comprehensive CFP courses, is recognized globally and can significantly enhance career prospects. Certified professionals are often preferred by employers and clients alike for their proven expertise and ethical conduct.

Trust and Credibility

Clients are more likely to trust a Certified Financial Planner as CFP courses instil not only knowledge but also a commitment to ethical behaviour, making certified planners reliable stewards of clients’ finances.

Personal and Professional Development

The knowledge and skills gained through CFP courses are valuable not just in one’s professional life but can also lead to more informed and practical personal financial decisions.

The Global Perspective

CFP courses, and the resulting certification, have a global appeal. The CFP mark is recognized in over 26 countries and territories, which signifies the advisor's credibility universally. As international finance becomes more interconnected, this global recognition becomes increasingly valuable.

The Path with ICOFP

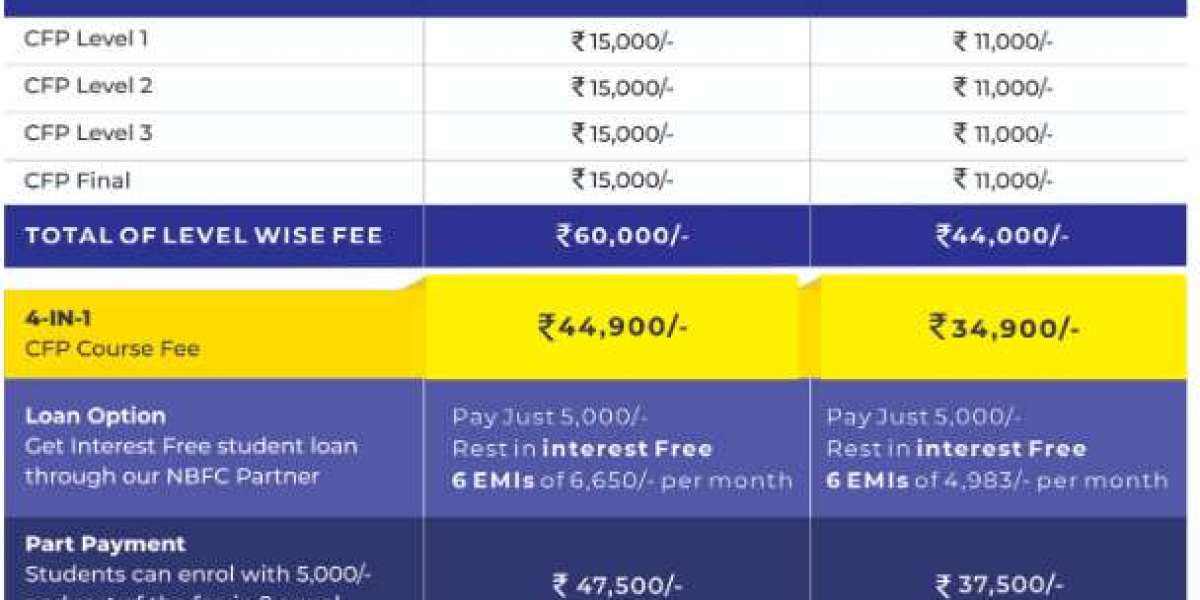

The International College of Financial Planning (ICoFP) offers one of the most prestigious CFP courses in India. This course is designed to prepare students for a successful career in financial planning thoroughly. The ICoFP program offers:

Industry-recognized Certification: ICoFP is approved by the Financial Planning Standards Board (FPSB) of India, ensuring that the certification is held to the highest standards.

Expert Faculty: Students are guided by experienced professionals who bring real-world insights into the classroom.

Flexible Learning Options: ICoFP offers students the flexibility to choose between classroom learning and a digital platform, allowing for a learning experience that suits various needs and schedules.

Placement Assistance: ICoFP provides vital placement assistance with a beautiful track record of placing students in prestigious financial institutions.

Empowering Your Financial Future

In a world where finances are ever evolving and growing in complexity, the role of a competent, ethical financial advisor is increasingly vital. CFP courses are a beacon for those aspiring to this influential and rewarding profession, offering a structured path towards mastery of the skills and knowledge needed to thrive.

For those in India, the CFP courses offered by ICoFP represent a golden opportunity to embark on this journey under the guidance of some of the nation’s most accomplished financial professionals. It’s more than a certification; it’s an empowerment of your career, a symbol of trust to your clients, and a commitment to your continuous growth in the ever-evolving world of finance.

To learn more about how CFP courses can empower your journey in financial planning, visit ICoFP's Certified Financial Planner (CFP) Certification program.