Understanding Final Investment Decisions (FIDs)

A Final Investment Decision (FID) is the moment when a company commits significant capital and resources to a specific oil and gas project. This decision represents a crucial juncture in the project's lifecycle, as it signals a commitment to moving forward with development and production. Making the right FID is essential for a company's profitability and success, but it is not a decision taken lightly.

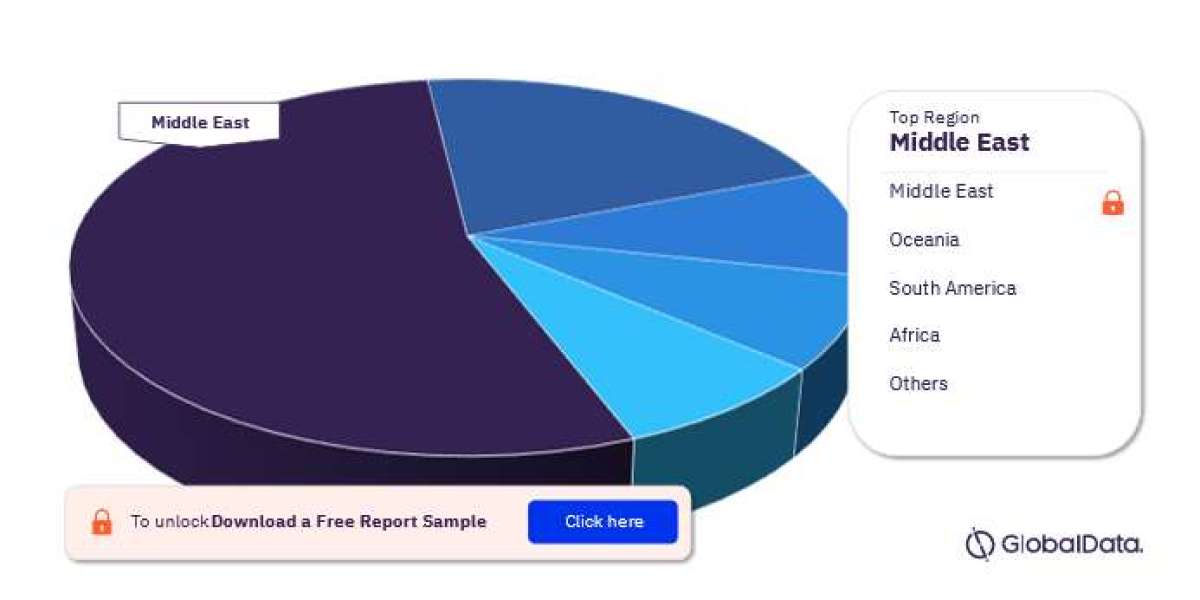

Market Overview

The Oil and Gas FID Market is highly competitive and susceptible to various external and internal factors. Key players in this market include major oil and gas companies, independent operators, and financial institutions that provide funding for projects. The projects under consideration can range from exploration and drilling ventures to large-scale production facilities and pipelines.

Factors Influencing FID

Oil Price Volatility: Oil prices play a significant role in FID considerations. Companies closely monitor and analyze oil price trends to determine the economic viability of a project. Low oil prices can deter investment, while high prices can make projects more attractive.

Technological Advances: Advancements in drilling techniques, automation, and digital technologies have the potential to reduce project costs and increase efficiency. Companies factor in the latest technologies when making FID assessments.

Regulatory Environment: Governments worldwide are increasingly imposing stricter regulations on emissions and environmental impact. Compliance with these regulations is a crucial consideration when making FIDs.

Geopolitical Risks: The global nature of the oil and gas industry means that geopolitical tensions and conflicts can impact FID decisions. Companies assess the stability of regions where projects are planned.

Resource Reserves: The size and quality of oil and gas final investments decisions market reserves in a given project area are fundamental factors in FID evaluations. Proven reserves increase the likelihood of a positive decision.

Market Demand: Assessing the demand for oil and gas products is crucial. Companies analyze current and future market conditions to determine if there is sufficient demand to justify project investment.

Economic Viability: Detailed financial modeling and analysis are conducted to determine if a project is economically viable. Factors such as production costs, transportation expenses, and expected revenue are considered.

Environmental Impact: Environmental considerations are increasingly important. Companies evaluate the environmental impact of their projects and explore ways to minimize harm through cleaner technologies and sustainable practices.

Case Study: Deepwater Exploration Project

To illustrate the complexity of FID decisions, consider a deepwater exploration project. This project involves drilling in challenging offshore environments, where risks and costs are high. Several factors must be carefully weighed:

Oil Price: Companies monitor global oil prices to determine if the project is economically viable at the current price per barrel.

Technological Advances: Advancements in subsea technology can significantly reduce drilling and maintenance costs, making the project more attractive.

Regulatory Environment: Strict environmental regulations apply to offshore drilling. Compliance with these regulations is non-negotiable.

Geopolitical Risks: The project's location in politically stable waters reduces geopolitical risks.

For more insights on the oil and gas final investments decisions market overview, download a free sample report