The Traditional Brokerage Model

Traditional Brokers Still Matter

While the digital age has ushered in a new era of insurance distribution, traditional brokerage firms continue to play a vital role. These experienced intermediaries provide consumers with personalized advice and tailored insurance solutions. Their expertise and ability to navigate the complex insurance landscape make them a preferred choice for many UK consumers.

Face-to-Face Interactions

One reason why traditional brokers endure is the importance of face-to-face interactions. Many consumers value the opportunity to sit down with a professional who can explain policy details, answer questions, and provide reassurance. This personal touch remains a significant driver of consumer satisfaction in the insurance industry.

The Rise of Online Aggregators

Convenience at Your Fingertips

In recent years, online aggregators have surged in popularity. These digital platforms allow consumers to compare multiple insurance quotes from various UK personal lines insurance industry providers with just a few clicks. The convenience and transparency offered by aggregators resonate with tech-savvy consumers looking for quick and cost-effective solutions.

The Quest for Competitive Pricing

Competitive pricing is a key motivator for consumers using online aggregators. With the ability to easily compare premiums, policyholders can identify cost-effective options that align with their budgets. This price-driven approach has disrupted the traditional insurance market.

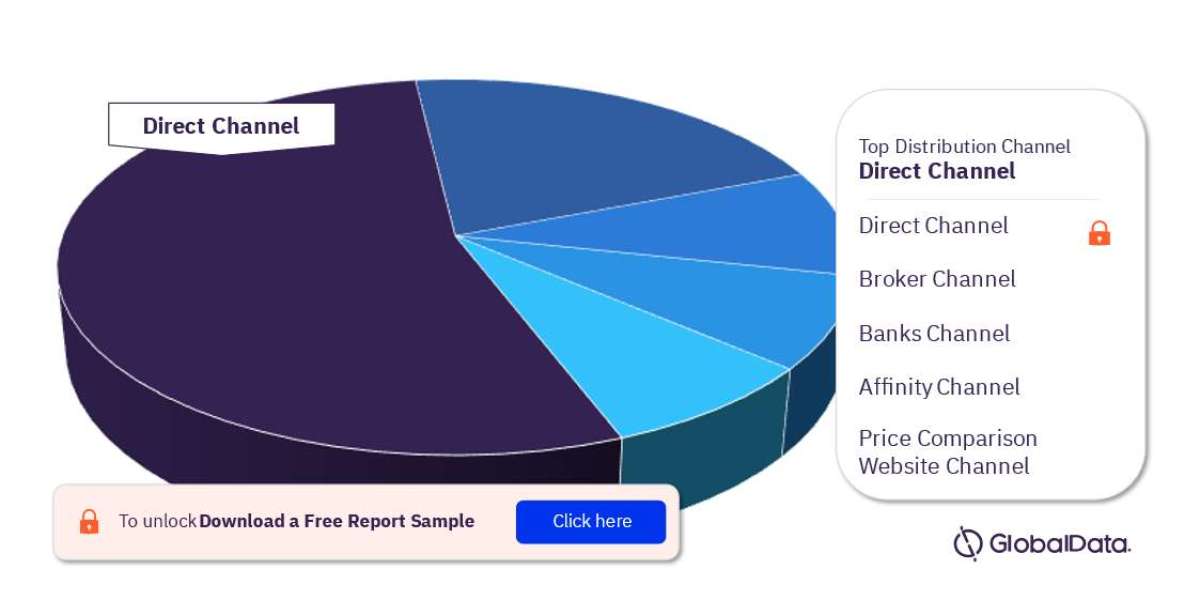

Direct-to-Consumer (DTC) Models

Cutting Out the Middleman

Direct-to-consumer models have gained traction as insurers seek to streamline their operations and reduce costs. By eliminating intermediaries, insurers can offer policies directly to consumers, potentially resulting in lower premiums. This approach appeals to those who prefer a straightforward transaction.

Digital Engagement

DTC insurers heavily invest in digital engagement. They leverage websites, mobile apps, and social media platforms to interact with consumers directly. This approach fosters a sense of control and accessibility for policyholders.

For more insights on the distribution channels in the UK personal lines insurance market, download a free report sample