Navigating Singapore's wealth management market landscape involves understanding the key players and the wide range of services they offer. Singapore is home to numerous domestic and international financial institutions that provide wealth management services to high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs).

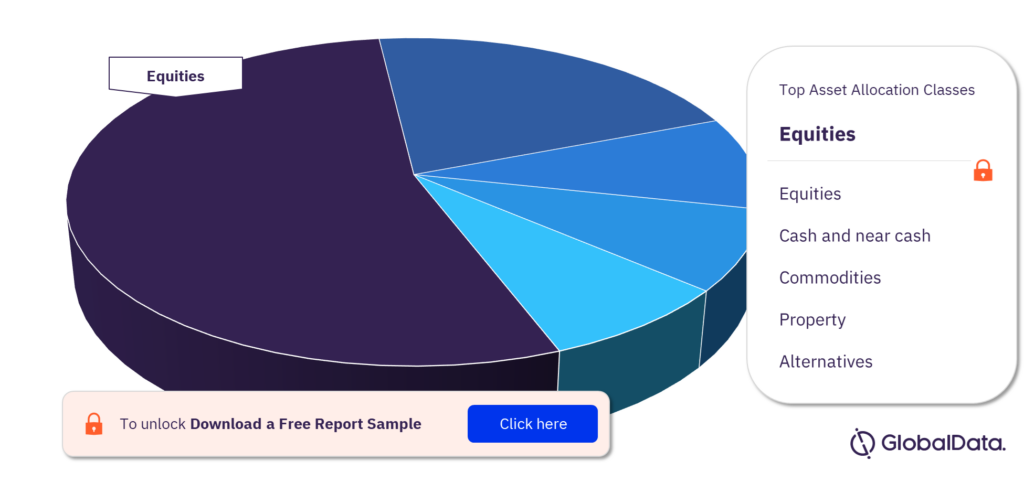

For more asset allocation classes, download a free sample

Here's an overview of some key players and the services they offer:

Key Players in Singapore's Wealth Management Market:

DBS Private Bank: DBS Bank is a leading financial institution in Asia, and its private banking arm, DBS Private Bank, offers a comprehensive range of wealth management services. These services include investment advisory, portfolio management, estate planning, and access to a wide range of investment products.

UOB Private Bank: United Overseas Bank (UOB) is a prominent bank in Singapore, and its private banking division, UOB Private Bank, provides wealth management solutions tailored to the needs of HNWIs and UHNWIs. Services include investment management, estate planning, and trust services.

OCBC Premier Banking: OCBC Bank's Premier Banking division offers personalized wealth management services to clients. They provide investment advisory, insurance planning, and access to a diverse range of investment products.

Credit Suisse: Credit Suisse is a global financial institution with a significant presence in Singapore's wealth management sector. They offer a wide array of wealth management and advisory services, including portfolio management, estate planning, and access to alternative investments.

UBS Wealth Management: UBS is another major international bank with a strong presence in Singapore. UBS Wealth Management offers a range of services, including investment advisory, asset management, legacy planning, and access to global markets.

Julius Baer: Julius Baer is a Swiss private bank with a presence in Singapore. They specialize in providing wealth management and private banking services to clients, including investment solutions and financial planning.

Citi Private Bank: Citibank's private banking division, Citi Private Bank, offers tailored wealth management services in Singapore. They provide investment strategies, lending solutions, and access to global markets.

HSBC Premier: HSBC Premier is HSBC's offering for affluent clients in Singapore. They provide wealth management services, including investment advisory, insurance planning, and access to international banking services.

Standard Chartered Private Bank: Standard Chartered offers private banking and wealth management services in Singapore. Their offerings include investment advisory, portfolio management, and wealth planning.

Wealth Management Services Offered:

Investment Advisory: Wealth managers in Singapore provide personalized investment advice based on clients' financial goals, risk tolerance, and market conditions.

Portfolio Management: They manage investment portfolios on behalf of clients, ensuring diversification and optimizing returns.

Estate and Legacy Planning: Wealth managers help clients plan for the transfer of wealth to the next generation, including wills, trusts, and estate tax considerations.

Tax Planning: They assist clients in optimizing their tax strategies to minimize tax liabilities while remaining compliant with local regulations.

Insurance and Risk Management: Wealth managers offer insurance solutions to protect against various risks, such as life insurance, health insurance, and wealth protection.

Retirement Planning: They help clients plan for a financially secure retirement by optimizing savings and investments.

Access to Alternative Investments: Many wealth managers provide access to alternative investments like hedge funds, private equity, and real estate.

Global Market Access: Clients can access international financial markets for diversification and investment opportunities.

Philanthropy and Charitable Giving: Wealth managers assist clients in developing philanthropic strategies and charitable giving plans.

Navigating the wealth management landscape in Singapore requires a careful assessment of individual financial goals and preferences. Clients should conduct due diligence when selecting a wealth manager and consider factors such as track record, expertise, and the range of services offered by the institution. Additionally, staying informed about market trends and regulations is crucial for making informed investment decisions.