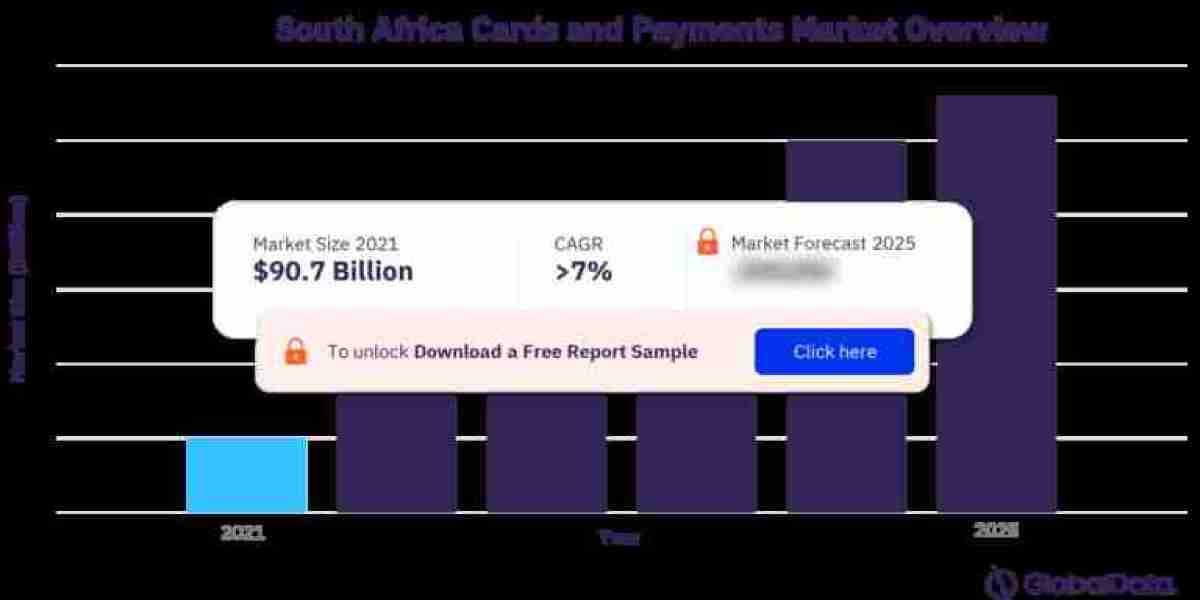

The South Africa Cards and Payments Market have evolved remarkably over the years. In this article, we will navigate through the historical progression, current payment methods, major market players, regulatory landscape, prevailing trends, challenges, and future prospects of this dynamic industry.

Historical Overview

South Africa's payment ecosystem has come a long way from traditional cash-based transactions to electronic payments. The early 2000s witnessed the introduction of debit and credit cards, gradually reducing the dependency on physical cash.

Payment Methods in South Africa

Traditional Methods

Despite the digital revolution, cash remains a popular payment method in South Africa. Many individuals and businesses still prefer physical currency for daily transactions.

Emergence of Digital Payments

In recent years, digital payments have gained South Africa cards and payments market significant traction. Mobile banking apps, online payments, and POS systems have become integral to the South African payment landscape.

Major Players in the Market

Leading Banks

South Africa's prominent banks, such as Standard Bank, ABSA, and Nedbank, play a pivotal role in the cards and payments market. They offer a wide range of financial products and services, including credit cards and digital wallets.

Fintech Disruptors

The fintech industry in South Africa is booming, with companies like Capitec Bank and TymeBank challenging traditional banking models. These disruptors have introduced innovative payment solutions, attracting tech-savvy consumers.

Regulatory Environment

Regulatory Bodies

The South African Reserve Bank (SARB) and the Payments Association of South Africa (PASA) oversee the country's payment systems. They ensure security, compliance, and fair competition within the industry.

Impact on Market Dynamics

Stringent regulations and compliance requirements have influenced the market dynamics, encouraging transparency and safeguarding consumer interests.

Market Trends

Contactless Payments

Contactless payments have gained immense popularity, especially in light of the COVID-19 pandemic. South Africans increasingly use contactless cards and mobile wallets for convenience and safety.

For more insights on the report, download a free sample