FinTech Blockchain Market Overview

The latest study from Maximize Market Research, " FinTech Blockchain Market " 2023-2029, is helpful in understanding the market’s competitors. The study takes a wide and basic look at the market, as well as a look into subjective variables that could give readers valuable business insights. The study includes a market overview that covers the value chain structure, regional analysis, applications, market size, and forecast (2022-2029). The study will be used to get a more accurate assessment of the existing and future state of the global Food Processing Machinery market.

The size of the FinTech Blockchain market was estimated at US$ 3.53 billion in 2022, and from 2023 to 2029, total FinTech Blockchain revenue is anticipated to increase by 75.80%, or roughly US$ 183.56 billion.

The Fintech ecosystem is composed of a wide range of participants who are all committed to innovation and boosting competition in the financial sector, ultimately benefiting customers and boosting economic production. The five distinctive elements of the fintech ecosystem include traditional financial institutions, government, technology developers, and fintech start-ups. In the last ten years, there have been numerous technological breakthroughs in fields including social media, artificial intelligence (AI), big data and cloud computing, virtual reality, and, most notably, blockchain. Based on its applications and innovation, fintech can be categorized into a number of industries.

Request Free Sample Copy (To Understand the Complete Structure of this Report [Summary + TOC]) :

@ https://www.maximizemarketresearch.com/request-sample/13770

FinTech Blockchain Market Scope and Methodology:

The report provides a comprehensive analysis of market participants in the FinTech Blockchain market. It provides a detailed analysis of the global, regional, national, and local markets within the FinTech Blockchain industry. The competitive analysis section highlights major industry players across various regions, offering insights into their revenue, financial standing, portfolio, and technical developments. Segment-wise analysis of the FinTech Blockchain market is conducted based on specific criteria, examining the factors that favorably and unfavorably impact market growth. By analyzing primary and secondary data sources, the report presents forecasts for market size, growth rate, and current and future trends in the FinTech Blockchain market. The bottom-up approach is utilized to validate the market size estimation for different segments. The report incorporates both primary and secondary data collection methods.

Qualitative and quantitative research methods are employed, utilizing tools such as SWOT analysis, PESTLE analysis, and Porter’s Five Forces analysis. These analytical tools provide valuable insights into the FinTech Blockchain market such as growth drivers and restraints. Overall, the report serves as a comprehensive guide for investors, stakeholders, and market followers of the FinTech Blockchain market, assisting them in making informed decisions.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report:

@ https://www.maximizemarketresearch.com/market-report/fintech-blockchain-market/13770/

FinTech Blockchain Market Regional Insights

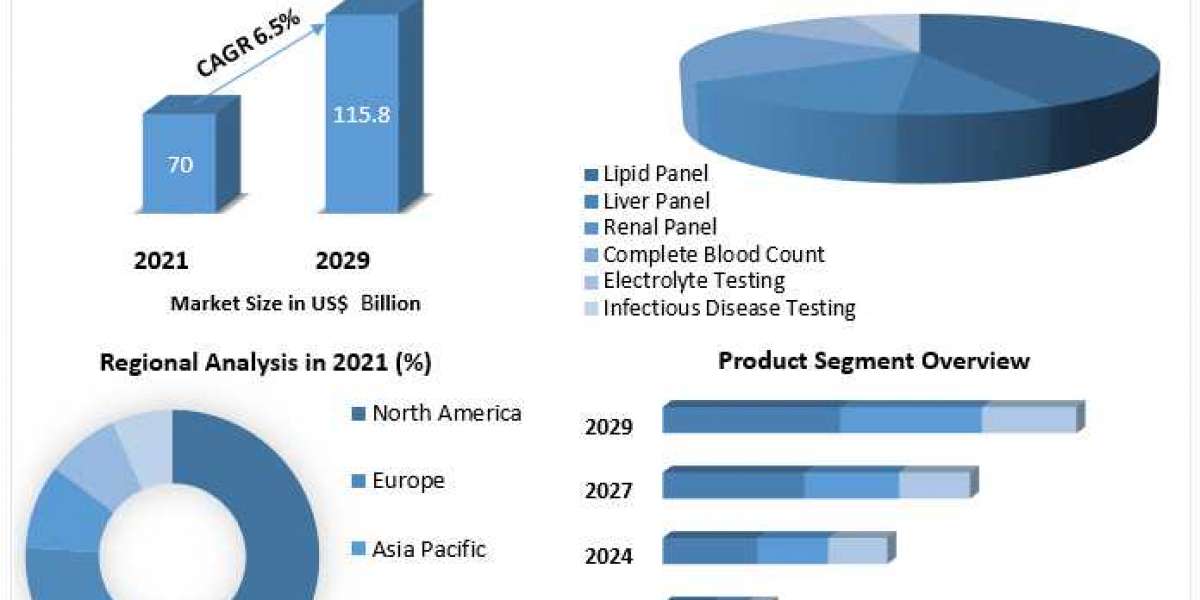

The report includes a thorough analysis of all the factors, market size, growth rate, and import and export in regions. The Regional Analysis provides the FinTech Blockchain market status of various countries included in the report. The FinTech Blockchain market is broadly segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

FinTech Blockchain Market Segmentation

SMEs are anticipated to expand at a CAGR of 8.9% over the course of the projection period in terms of Organization Size. Small firms use fintech to outsource complexity and expertise since they have less time, money, and human resources to spend to creating their own specialized digital solutions. For SMEs, APIs and other low-code, plug-and-play solutions in general are very helpful since they let them launch digital solutions as quickly as possible, with no upfront costs and no disruption to operations.

When compared to larger businesses, SMEs have different financial challenges. Smaller businesses frequently have sophisticated finances that are constrained in scope, which makes it challenging for them to get conventional financings like loans, equity, or trade credit. This is a commercial issue that fintech was created to address. Peer-to-peer (P2P) lending, invoice financing, and equity crowdfunding are non-traditional forms of capital access offered to SMEs by non-traditional financing platforms like Funding Societies, SmartFunding, and FundedHere, enabling business owners to achieve next-stage growth.

1 Global FinTech blockchain Market, by Application (2022-2029)

• Payments, clearing, and settlement

• Exchanges and remittance

• Smart contracts

• Identity management

• Compliance management/Know Your Customer (KYC)

• Others (cyber liability and content storage management

2 Global FinTech blockchain Market, by Provider (2022-2029)

• Application and solution providers

• Middleware providers

• Infrastructure and protocols providers

3 Global FinTech blockchain Market, by Organization Size (2022-2029)

• Small and Medium-Sized Enterprises (SMEs)

• Large enterprises

4 Global FinTech blockchain Market, by Industry Vertical (2022-2029)

• Banking

• Non-banking financial services

• Insurance

Please connect with our representative, who will ensure you to get a report sample here

@ https://www.maximizemarketresearch.com/request-sample/13770

FinTech Blockchain Market Key Players

1. AWS

2. IBM

3.Microsoft

3. Ripple

4. Chain

5. Earthport

6. Bitfury

7. BTL

8. Oracle

9. Digital Asset

10. Circle

11. Factom

12. Alphapoint

13. Coinbase

14. Abra

15. Auxesis

16. Bitpay

17. Blockcypher

18. Applied Blockchain

19. Recordskeeper

20. Symboint

21. Guardtime

22. Cambridge Blockchain

23. Tradle

24. Robinhood

25. Veem

26. Stellar

Table Of Content :

1. Global FinTech Blockchain Market: Research Methodology

2. Global FinTech Blockchain Market: Executive Summary

2.1 Market Overview and Definitions

2.1.1. Introduction to Global FinTech Blockchain Market

2.2. Summary

2.2.1. Key Findings

2.2.2. Recommendations for Investors

2.2.3. Recommendations for Market Leaders

2.2.4. Recommendations for New Market Entry

3. Global FinTech Blockchain Market: Competitive Analysis

3.1 MMR Competition Matrix

3.1.1. Market Structure by region

3.1.2. Competitive Benchmarking of Key Players

3.2 Consolidation in the Market

3.2.1 M&A by region

3.3 Key Developments by Companies

3.4 Market Drivers

3.5 Market Restraints

3.6 Market Opportunities

3.7 Market Challenges

3.8 Market Dynamics

3.9 PORTERS Five Forces Analysis

3.10 PESTLE

3.11 Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• The Middle East and Africa

• South America

3.12 COVID-19 Impact

Important inquiries addressed in the FinTech Blockchain Market are:

- What is FinTech Blockchain ?

- What are the global trends in the FinTech Blockchain Market?

- What was the FinTech Blockchain Total Market size in 2023?

- What is expected FinTech Blockchain Market size by 2029?

- Who held the largest market share in FinTech Blockchain Market?

- Who are the leading companies and what are their portfolios in FinTech Blockchain Market?

- What are the major challenges that the FinTech Blockchain Industry could face in the future?

COVID-19 Impact Analysis on FinTech Blockchain Market:

end-user industries utilizing FinTech Blockchain experienced a drop in growth in several countries, including China, Italy, Germany, the United Kingdom, the United States, Spain, France, and India, due to operational pauses amid increasing COVID-19 cases and lockdowns. This decline in end-user industry revenues led to a significant decrease in demand for FinTech Blockchain manufacturers, directly impacting the growth of the FinTech Blockchain Market in 2023. The global increase in COVID-19 instances contributed to the sharp decline in demand for FinTech Blockchain products as businesses faced challenging conditions during this period.

Key Offerings:

- Past Market Size and Competitive Landscape (2017 to 2022)

- Past Pricing and price curve by region (2017 to 2022)

- Industrial Manipulator Market Size, Share, Size Forecast by different segment | 2023−2029

- Industrial Manipulator Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

- Industrial Manipulator Market Segmentation – A detailed analysis by Type, Application and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- Competitive landscape – Market Leaders, Market Followers, Regional player

- Competitive benchmarking of key players by region

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of business by region

- Lucrative business opportunities with SWOT analysis

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Contact Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

444 West Lake Street, Floor 17, Chicago, IL, 60606, USA.

+1 800 507 4489 +91 9607365656

https://www.maximizemarketresearch.com

Related Reports:

Artificial Neural Network Market: https://www.maximizemarketresearch.com/market-report/global-artificial-neural-network-market/83873/

Oil Change Service Market: https://www.maximizemarketresearch.com/market-report/oil-change-service-market/201385/