The Lesotho insurance industry is undergoing significant transformation, driven by technological advancements, regulatory changes, and shifting consumer preferences. This article explores the key trends and opportunities that are expected to shape the industry's trajectory up to 2025.

Digital Transformation and Customer Experience

Digitalization is revolutionizing the way insurance products and services are delivered. Insurers are investing in user-friendly online platforms, mobile apps, and AI-powered chatbots to enhance customer interactions. This trend not only improves convenience but also boosts customer loyalty.

Emergence of Microinsurance

Microinsurance is gaining traction, especially in underserved markets. Lesotho's insurance sector is recognizing the potential of catering to low-income individuals Lesotho insurance industry with tailored microinsurance products that provide coverage for specific risks at affordable premiums.

Health and Wellness Initiatives

Insurance companies are shifting from a reactive approach to a proactive one by focusing on health and wellness initiatives. They are partnering with wellness providers and offering incentives for policyholders to lead healthier lifestyles, ultimately leading to reduced claims and improved customer well-being.

Growth in Commercial Insurance

As businesses expand in Lesotho, the demand for various types of commercial insurance, including property, liability, and professional indemnity, is on the rise. This trend presents an opportunity for insurers to offer specialized coverage solutions to protect businesses against diverse risks.

Regulatory Developments and Compliance

Regulatory changes are reshaping the insurance landscape, with a focus on consumer protection and transparency. Insurers that adapt to these changes efficiently can gain a competitive advantage while maintaining customer trust.

Collaborations and Partnerships

Collaborations between insurance companies and other industries, such as technology and healthcare, are becoming more common. These partnerships can lead to innovative product offerings, streamlined operations, and improved customer experiences.

Rise of Insurtech Startups

Insurtech startups are disrupting traditional insurance models by leveraging cutting-edge technologies like AI, blockchain, and IoT. These startups are introducing new ways of underwriting, claims processing, and risk assessment, pushing established insurers to innovate.

Sustainable and Ethical Practices

Consumers are increasingly conscious of environmental and social issues. Insurance companies that adopt sustainable and ethical practices not only contribute to positive change but also attract socially responsible customers.

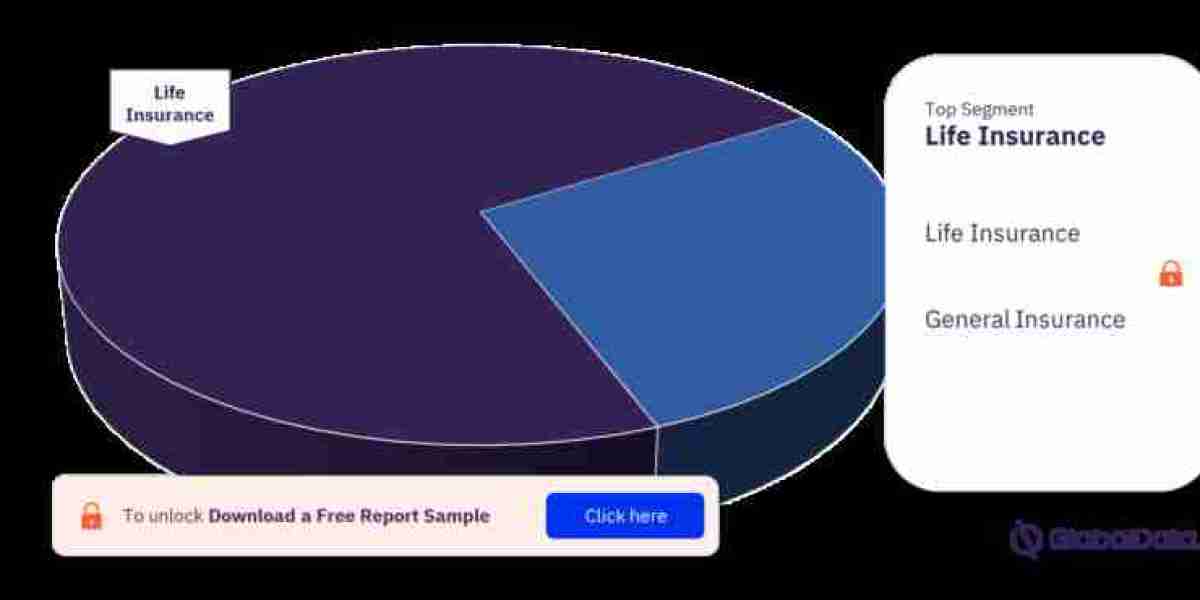

For more segment insights, download a free report sample