The insurance industry in Pakistan, like many other sectors, has been undergoing a process of digital transformation. This transformation is driven by technological advancements, changing customer expectations, and the need for operational efficiency.

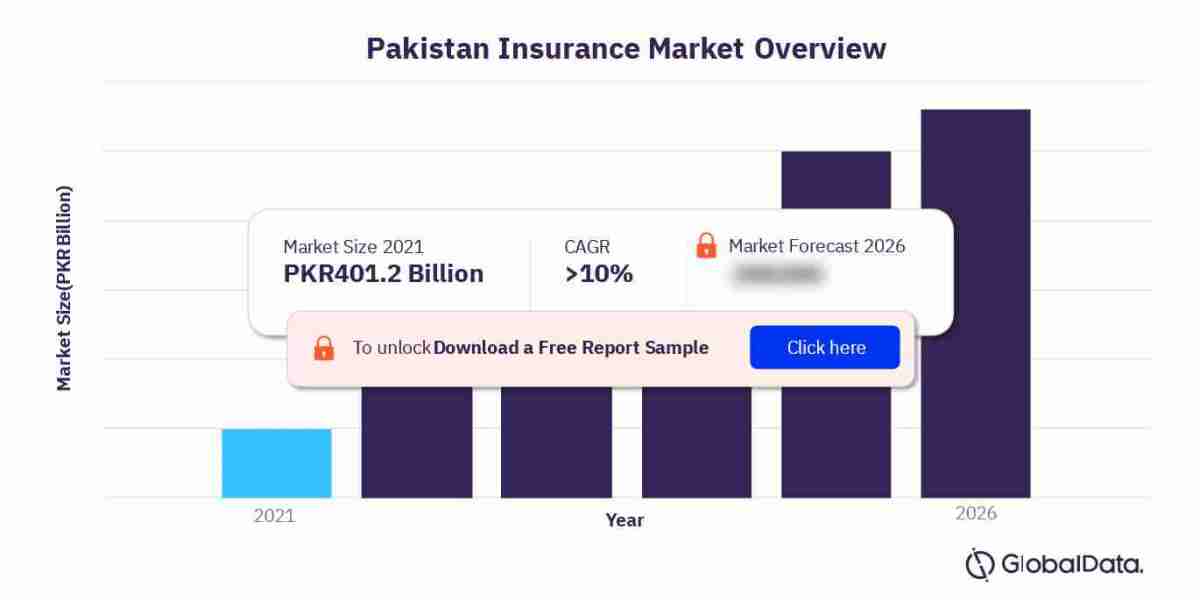

For more insights on the Pakistan insurance industry forecast, download a free report sample

Here are some ways in which digital transformation has been impacting the Pakistan insurance industry:

Online Policy Purchases and Renewals: Insurance companies are increasingly offering the option for customers to purchase and renew insurance policies online. This provides convenience to customers and reduces the need for in-person visits to insurance offices.

Digital Claims Processing: Digital platforms are being utilized for claims processing, allowing customers to submit claims online, track their status, and receive updates digitally. This streamlines the claims process and improves customer experience.

Mobile Apps: Insurance companies are developing mobile applications that allow customers to access policy information, make premium payments, and initiate claims using their smartphones.

Chatbots and Virtual Assistants: Chatbots and virtual assistants are being used to provide instant customer support, answer queries, and guide customers through various insurance processes.

Big Data and Analytics: Insurers are leveraging data analytics to gain insights into customer behavior, risk assessment, and claims prediction. This enables more accurate underwriting and personalized offerings.

Telematics and IoT: In the motor insurance sector, telematics devices and Internet of Things (IoT) technology are used to monitor driving behavior and offer usage-based insurance plans.

Digital Marketing and Sales: Insurance companies are utilizing digital marketing strategies to reach potential customers through social media, online advertising, and targeted campaigns.

E-KYC and Digital Documentation: Digital Know Your Customer (e-KYC) processes are being adopted to verify customer identities, reducing the need for physical documentation.

Data Security and Privacy: As digital interactions increase, insurance companies are investing in cybersecurity measures to protect customer data and ensure privacy compliance.

Remote Underwriting: Digital platforms allow for remote underwriting processes, enabling insurers to assess and approve policies without requiring customers to visit physical offices.

E-Claims Settlement: Some insurers are exploring blockchain technology for secure and transparent claims settlement processes.

Digital Insurance Aggregators: Online insurance aggregators and comparison platforms are emerging, allowing customers to compare different insurance options and make informed decisions.

Digital transformation in the Pakistan insurance industry has the potential to enhance customer engagement, improve operational efficiency, and enable insurers to offer more tailored and competitive products. However, challenges such as digital literacy, data security, and regulatory compliance must be addressed to fully harness the benefits of digital advancements.

Please note that developments in digital transformation may have occurred since my last update. For the latest information on digital transformation in the Pakistan insurance industry, I recommend consulting industry reports, news sources, and official communications from insurance regulatory authorities.