With the soaring sales of electric rickshaws in different cities and towns, on account of the rising popularity of eco-friendly vehicles, the demand for electric rickshaw battery is growing steeply in India. According to statista, more than 380,000 electric rickshaws were sold across India in 2018. This is credited to the fact that e-rickshaws have lower operating costs than the other variants, such as the conventionally used auto-rickshaws. Additionally, the government is providing strong support, in the form of financial incentives, for boosting the deployment of these economical vehicles in the country.

For example, under the second phase of the Faster Adoption and Manufacturing of (Hybrid ) Electric Vehicles (FAME-II) scheme, that came into effect in April 2019, the government provides $735 (INR 50,000) each to five lakh electric rickshaws having ex-factory prices of up to $7,351 (INR 5 lakh). Besides, the increasing average age of electric rickshaws in India is also fueling the demand for electric rickshaw batteries in the country. Initially, the industry was mainly dominated by local and unorganized players.

As a result, the rickshaws were of poor quality and had an average lifespan of 1.8 years. However, after the launch of the Goods Services Tax (GST), the industry has witnessed the entry of several organized manufacturers. As the rickshaws manufactured by these companies have an average lifespan of 3.5 years, their surging production is propelling the demand for electric rickshaw batteries in the country, thereby driving the progress of the Indian electric rickshaw battery market.

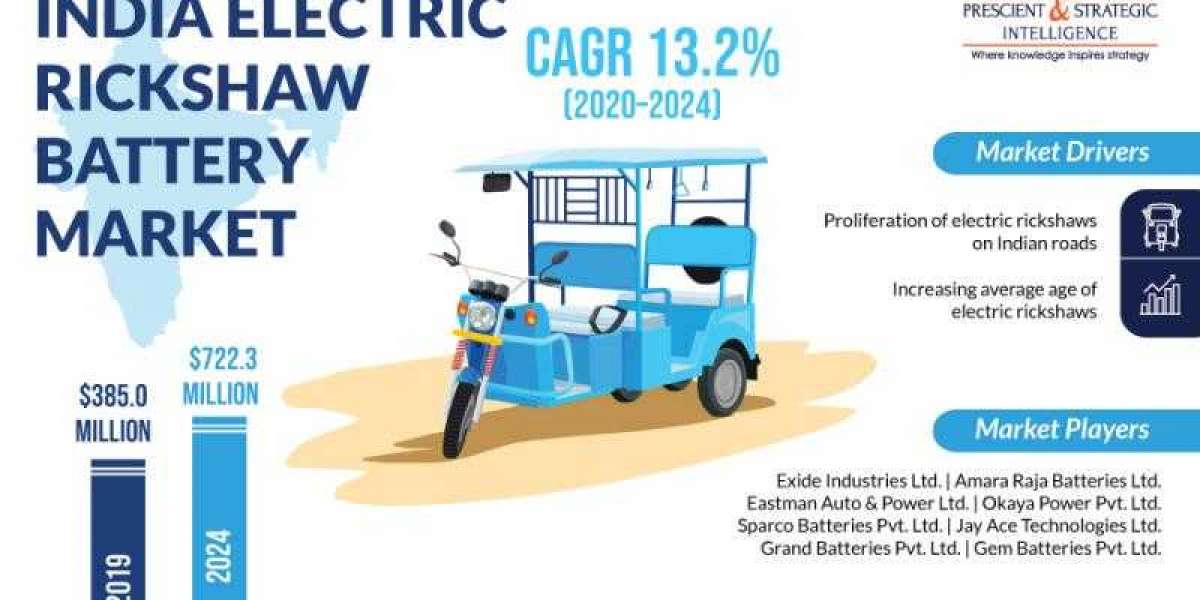

According to the estimates of the market research company, PS Intelligence, the market revenue will grow from $385.0 million to $722.3 million by 2024. Moreover, the market is predicted to progress at a CAGR of 13.2% from 2020 to 2024. Depending on vehicle, the Indian electric rickshaw battery market is bifurcated into passenger and load carriers. Between these, the passenger carrier category held the largest share in the market in the years gone by.

This is credited to the existence of a large passenger pool and the growing demand for convenient public transport for last-mile connectivity in the country. On the other hand, in the forthcoming years, the load carrier category will demonstrate faster growth in the market, on account of the lower total cost of ownership (TCO) of these vehicles in comparison to the passenger carriers. The Indian electric rickshaw battery market was dominated by Delhi in 2018.

However, Uttar Pradesh overtook the capital city and became the largest market in 2019. This is ascribed to the soaring adoption of these vehicles by commuters, especially in the small towns, because of their lower fare than the other public transport vehicles. In addition to this, many cities in the rural-urban fringes and tier-2 cities also adopted these vehicles for improving feeder services and last-mile connectivity, thereby causing a sharp surge in electric rickshaw battery demand in the state.

Hence, it is safe to say that the sales of electric rickshaw batteries will shoot up in India in the coming years, primarily because of the growing adoption of electric rickshaws in the country.