Europe Digital Payment Market Analysis and Size

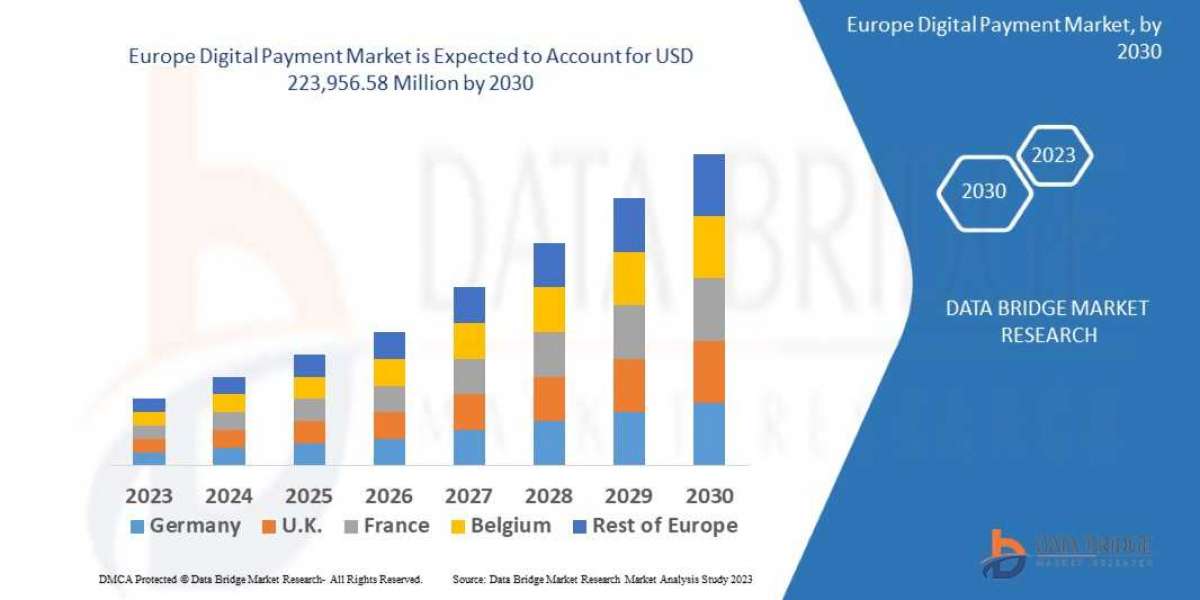

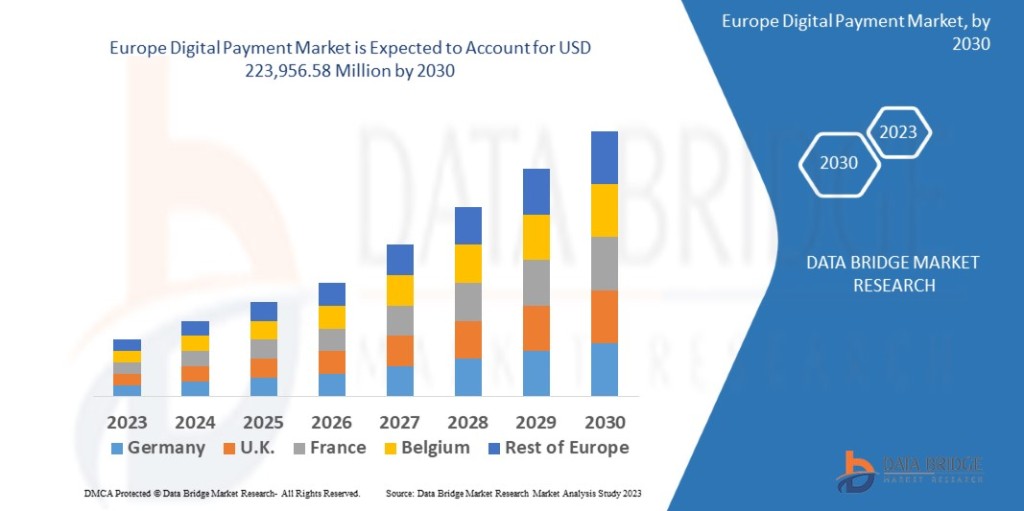

Data Bridge Market Research analyses that the digital payment market is expected to reach USD 223,956.58 million by 2030, which is USD 56,827.44 million in 2022, at a CAGR of 18.70% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

The Market Dynamics of the Europe Digital Payment Market Include:

Drivers

- Growth and expansion of e-commerce

Growth and expansion of e-commerce has contributed to a surge in the digital financial services associated with consumers and small businesses which is boosting the growth of the digital payment market. For instance, many e-commerce platforms are seeing surge in the usage of digital payments, mainly digital wallet which is a digital payment system for helping the consumers with instant and safe transactions. Therefore, the growth and expansion of e-commerce is likely to drive the market growth.

- Increasing demand of digital payment in banking, financial services and insurance (BFSI) sector

Banking, financial services and insurance (BFSI) sector is the dominant sector which is anticipated to have the major impact on the digital payment market. In last few years, insurance, financial services, and stockbroking businesses have witnessed a huge change in the way they receive and disburse funds. Therefore, surge in demand for digital payment for cross-border and domestic transactions in banking, financial services and insurance (BFSI) sector is expected to boost the market growth.

Opportunities

- Increasing efforts by bank to launch European payment initiative

Banks in Europe are making several efforts to introduced European payment initiative which aimed at generating unified payments solution for consumers and sellers across this region. Such initiatives are anticipated to generate lucrative opportunities for the growth of the market during the forecast period.

- Rapid growth in smartphone users

A rapid growth in smartphone users in developing region of Europe, making the digital payment process user-friendly and more convenient option. Business outlets highly opting to adapt with mobile-based payment applications such as Pay Pal, Apple Pay, Google pay, Phone May, Amazon pay, and many other. Hence, thegrowth in smartphone users will likely to create ample opportunities for the market growth.

Restraints

- Rising cyber-attacks on digital payments

Cyber-attacks are the major factor which is expected to hamper the growth of the digital payment market. These attacks are the major issues that the payment sector has faced in a long period of time. The increasing usage of digital payment systems is also rising the cybersecurity dangers such as fraud and cyber theft.

- Increasing hesitance and fear among people

Increasing hesitance and fear among people in underdeveloped areas of Europe in regards to the security and safety in digital payments such as fraudulent payment apps, reverse engineering and tampering and many more will hamper the growth of the market.

| REPORT METRIC | DETAILS |

| Forecast Period | 2022 to 2030 |

| Base Year | 2022 |

| Historic Years | 2021 (Customizable to 2015 - 2020) |

| Quantitative Units | Revenue in USD Million, Volumes in Units, Pricing in USD |

| Segments Covered | Offering (Solutions, Services), Deployment Model (On Premises, Cloud), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Mode of Payment (Payment Cards, Point of Sale, Unified Payments Interface (UPI) Service, Mobile Payment, Online Payment), Mode of Usage (Mobile Application, Desktop/Web Browser), Technology (Application Programming Interface (API), Data Analytics and Machine Learning, Digital Ledger Technology (DLT), Artificial Intelligence and Internet of Things, Biometric Authentication), Use Case (Person (P/C), Merchant/ Business, Government), End User (Commercial, Consumer) |

| Country Covered | Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

| Market Players Covered | ACI Worldwide (U.S.), PayPal, Inc. (U.S.), Novatti Group Limited (Australia), Global Payments Inc. (U.S.), Visa (U.S.), Stripe, Inc. (Ireland), Google, LLC (U.S.), Finastra. (U.K.), SAMSUNG (South Korea), Amazon Web Services, Inc. (U.S.), Financial Software Systems Pvt. Ltd. (U.S.), Aurus Inc. (U.S.), Adyen (Netherlands), Apple Inc. (U.S.), Fiserv, Inc. (U.S.), WEX Inc. (U.S.), wirecard (U.S.), Mastercard. (U.S.) among many others. |

| Market Opportunities | Increasing efforts by bank to launch European payment initiative Rapid growth in smartphone users |

Access PDF Sample Report (Including Graphs, Charts Figures) @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=europe-digital-payment-market

Europe Digital Payment Market Scope

The digital payment market is segmented on the basis of offering, deployment model, organization size, mode of payment, mode of usage, technology, use case, end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Consulting

- Implementation

- Support and Maintenance

- Managed Services

Deployment Model

- On Premises

- Cloud

Organization Size

- Large Enterprises

- Small Medium Enterprises (SMEs)

Mode of Payment

- Payment Cards

- Debit Card

- Credit Card

- Pre-Paid Card

- Point of Sale

- Unified Payments Interface (UPI) Service

- Mobile Payment

- Online Payment

Mode of Usage

- Mobile Application

- Desktop/Web Browser

Technology

- Application Programming Interface (API)

- Data Analytics and Machine Learning

- Digital Ledger Technology (DLT)

- Artificial Intelligence and Internet of Things

- Biometric Authentication

Use Case

- Person (P/C)

- Merchant/ Business

- Government

End User

- Commercial

- Consumer

To Gain More Insights about this Research, Visit @ https://www.databridgemarketresearch.com/reports/europe-digital-payment-market

Major TOC of the Report

- Introduction

- Market Segmentation

- Executive Summary

- Premium Insights

- Europe Digital Payment Market: Regulations

- Market Overview

- Europe Digital Payment Market, By Type

- Europe Digital Payment Market, By Source

- Europe Digital Payment Market, By Therapy

- Europe Digital Payment Market, By Transporting Capacity

- Europe Digital Payment Market, By Route of administration

- Europe Digital Payment Market, By Region

- Europe Digital Payment Market: Company Landscape

- SWOT Analyses

- Company Profile

Get TOC of the Report:-

https://www.databridgemarketresearch.com/toc/?dbmr=europe-digital-payment-market

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best Market opportunities and foster efficient information for your business to thrive in the Market

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: [email protected]

Browse Related Reports@

Discrete Semiconductor Market – Industry Trends and Forecast to 2029

Medical Spa Market – Industry Trends and Forecast to 2030

Stainless Steel Market – Industry Trends and Forecast to 2029